By Vera Pavlakovich-Kochi, Ph.D., Senior Regional Scientist and Associate Professor of Geography

December 2017

It is not surprising that the looming possibility of the U.S. government imposing a “border tax” on imports of transportation equipment from Mexico has raised many concerns. In 2016, transportation equipment accounted for 25.1% of total dollar value of combined imports and exports between the U.S. and Mexico. The official definition of “transportation equipment” includes everything from motor vehicles bodies and trailers, a multitude of motor vehicle parts, finished cars and trucks, as well as, aerospace products from aircraft engines, aircraft parts, and auxiliary equipment. Guided missiles and space vehicle propulsion units and accompanying parts and auxiliary equipment are also included in this important import category.

Compared with national data, transportation equipment products comprise a relatively smaller share of total Arizona trade with Mexico, 11% in 2016. Here are three facts to keep in mind as we contemplate possible impacts on Arizona’s economy of a re-introduction of import tariffs.

Fact One: The rising importance of transportation equipment in Arizona’s trade with Mexico

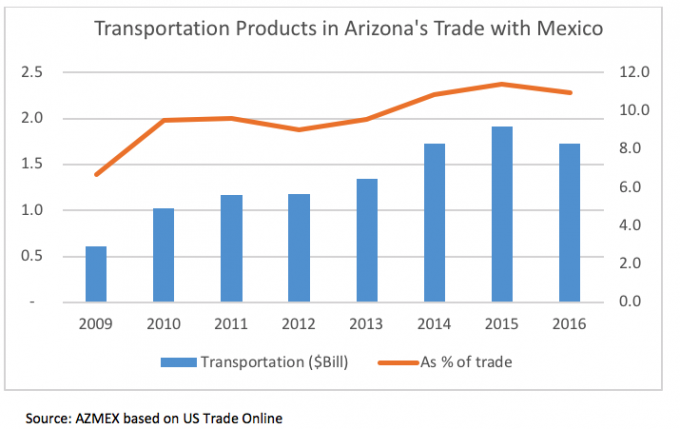

The value of transportation equipment products traded between Arizona and Mexico increased from less than a billion in 2008 to $1.7 billion in 2016, reaching its overall high in 2015. The share in the total trade increased in the same period from 7.7% to 11.0%, signalling a raise in the overall importance of transportation equipment ( Figure 1 ).

Figure 1. Transportation equipment products in Arizona’s trade with Mexico

Fact Two: Trade with Mexico in Transportation Equipment: more than just one-way street

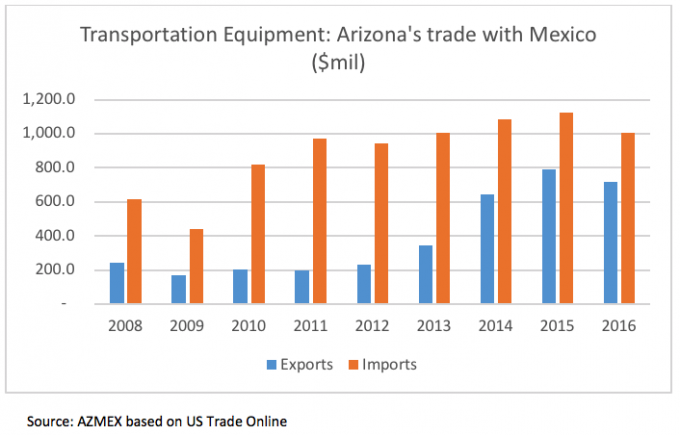

Starting with the maquiladora program in the mid-1960s, followed by expansion under NAFTA since early 1990s, and continuing into the 21st century, the production of transportation equipment has developed into a highly integrated crossborder endeavor. It is pretty much a common knowledge that, for example, cars imported from Mexico are built largely with U.S. components thus dispelling an old notion of imports as “foreign” things. This is why when we disaggregate trade into imports and exports, we see that transportation equipment is both an export as well as an import category (Figure 2).

Figure 2. Transportation equipment in Arizona’s trade with Mexico ($mil)

Fact Three: Exports of transportation equipment rose faster than imports

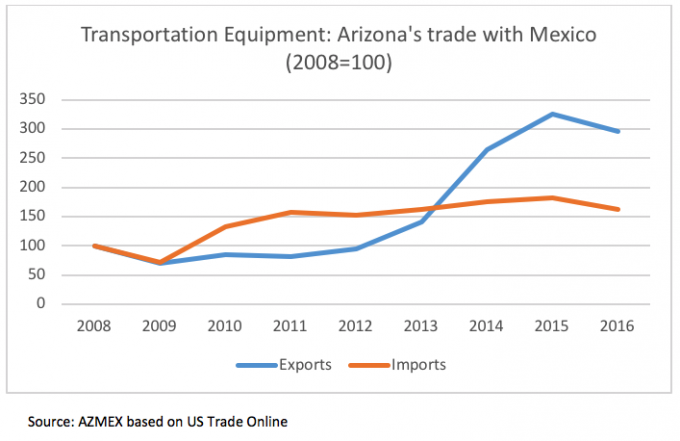

From Arizona’s perspective, it has been a welcoming fact that since 2012 the export of transportation equipment to Mexico grew faster than imports (Figure 3). Geography is partially to commend: the neighboring state of Sonora is home to the Ford Motor Company and one of Mexico’s five aerospace clusters.

Figure 3. Transportation equipment in Arizona’s trade with Mexico (2008=100)

For more data and analysis on Arizona trade visit EBRC’s Arizona-Mexico Economic Indicators website.