Arizona’s Fourth Quarter 2017 Economic Outlook Update*

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

December 1, 2017

Arizona is generating solid economic growth, outpacing the nation but not keeping up with our own past history. Job gains decelerated again in the third quarter, continuing the pattern begun at the end of 2016. Income gains have been a bit stronger so far this year, likely reflecting the increase in the state’s minimum wage and tighter overall labor markets.

The outlook calls for the state to continue to grind out solid gains, assuming the national economy avoids recession. While those gains are expected to beat the national average, they will likely be slow compared to growth rates routinely posted during the 30 years before the Great Recession. Most of the job growth during the next decade will be in service-providing sectors, particularly education and health services; professional and business services; trade, transportation, and utilities; and leisure and hospitality.

Both of Arizona’s largest metropolitan statistical areas (MSAs) are forecast to expand during the forecast period. The Phoenix MSA is expected to remain the economic engine of the state, driving job, income, and population growth. The Tucson MSA economy is expected to continue improving, but at a moderate pace.

Arizona Recent Developments

Arizona’s job growth lost momentum in 2017, with over-the-year gains gradually decelerating throughout the year, at least according to preliminary estimates. The state added 40,200 jobs over the year in the third quarter of 2017, which translated into 1.5% growth. That was slightly above the U.S. rate of 1.4%, but well below state job gains in the third quarter of 2016 of 2.8%.

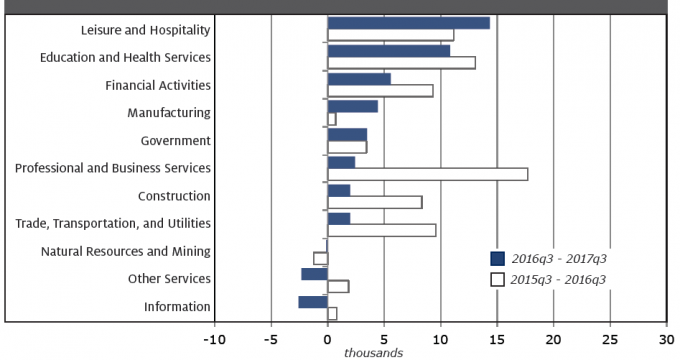

As Exhibit 1 shows, over-the-year job gains in the third quarter of 2017 were driven by leisure and hospitality; education and health services; financial activities; and manufacturing. These four sectors accounted for 87.6% of state job growth during the period. Gains in leisure and hospitality were concentrated in eating and drinking places. Health care and social assistance generated most of the gains in the larger education and health services sector. Finance and insurance jobs drove gains in financial activities, with little growth in real estate employment. Durable manufacturing jobs generated most of the increase in state manufacturing employment, thanks to increases other durable manufacturing (with a little help from aerospace and fabricated metals). Government (primarily state and local education); professional and business services; trade, transportation, and utilities; and construction also contributed to job gains over the year. Employment in natural resources and mining was stable.

Two industries lost jobs during the past year: other services, down 2,300, and information, down 2,500. Other services includes personal services (barbers, laundry services, etc.) and membership organizations. Information includes broadcasting, telecommunications, printing, and data processing, as well as a wide range of other technology-oriented industries.

As Exhibit 1 also shows, the recent slowdown in overall job growth was driven by decelerations in professional and business services; trade, transportation, and utilities; construction; other services; financial activities; information; education and health services; and government. Job gains accelerated recently in leisure and hospitality and manufacturing. The drag from job losses in natural resources and mining lessened during the past year.

Exhibit 1: Arizona’s Job Growth Decelerated During The Past Year

Over-The-Year Job Growth By Industry

On the international front, Arizona’s merchandise exports continued to decline through the first nine months of 2017. They have fallen by 5.5% from the first nine months of 2016 and are down 10.0% from the same period of 2015 (the peak). Arizona exports to Mexico, our most important export destination, have fallen 9.4% so far this year and have decline 19.4% from their 2015 peak. Exports to Canada have declined 3.8% this year and are off 11.9% from their peak. The export decline was likely driven in part by the strong U.S. dollar, which in September was up 13.9% versus major currencies since mid-2014. The dollar has risen even more dramatically against the Mexican peso, with a 37.2% increase since mid-2014. Other things the same, an increase in the U.S. dollar versus foreign currencies tends to depress exports and increase imports. However, it’s important to keep in mind that many other factors may be influencing exports as well, including economic activity domestically and abroad and political events, among other factors.

While merchandise exports account for a large share of export activity, exports of services matter as well. One dimension of service exports in Arizona is the spending of Mexican visitors. While we do not have monthly estimates of Mexican visitor spending in the state, EBRC publishes data on legal northbound border crossings through our border ports of entry on the Arizona-Mexico Economic Indicators site (azmex.eller.arizona.edu). These data suggest that the number of people crossing the border into Arizona continues to increase, but at a somewhat slower pace than earlier in the decade. That slowdown may be connected to rising tourism costs driven by the appreciation of the U.S. dollar.

Arizona Outlook

The outlook for the Arizona economy depends in part on global and national economic performance. Likewise, the Arizona, Phoenix, and Tucson forecasts depend on a forecast for the U.S. economy produced by IHS Markit in October 2017. This differs from forecasts released so far this year in that it no longer assumes that fiscal stimulus boosts growth in 2018-2019. Thus, real GDP growth is expected to average 2.2% in 2017, 2.4% in 2018, and then gradually decelerate to 1.7% by 2027.

The U.S. unemployment rate is expected to decline from 4.9% in 2016 to 4.4% this year and then to 4.3% in 2018. After 2020, the unemployment rate drifts up modestly, reflecting somewhat slower output gains. Nonetheless, the U.S. unemployment rate is expected to return to levels last seen in the late 1990s and early 2000s.

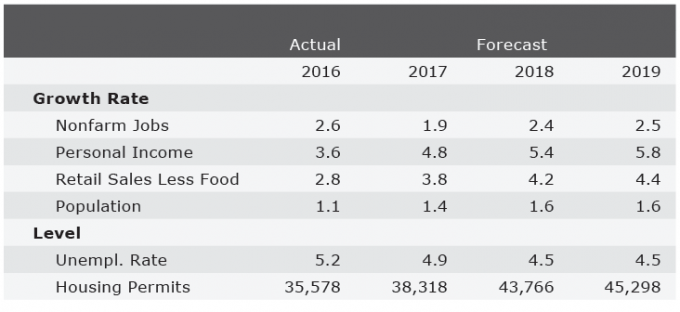

Sustained U.S. growth sets the stage for the Arizona economy to continue to expand, as Exhibit 2 shows. The forecast calls for state job growth to decelerate from 2.6% in 2016 to 1.9% in 2017, reflecting slowing job growth so far this year. Job gains accelerate modestly in 2018 and 2019, to 2.4% and 2.5% respectively. Overall, state job growth remains well above the national rate, but below average growth during the 30 years before the Great Recession.

Most job gains during the next decade are forecast to come in the service-providing sector, particularly education and health services; professional and business services; trade, transportation and utilities; and leisure and hospitality. These four sectors alone account for 72.7% of net job growth during the next 10 years.

With continued job growth during the forecast, the state unemployment rate is forecast to fall from 5.2% in 2016, to 4.5% by 2019.

Modestly accelerating job growth drives up net migration during the next two years, which contributes to stronger population gains. Population growth is forecast to accelerate from 1.1% last year to 1.6% by 2018. That’s better than recent results and the national average, but still slow compared to the state’s long-run growth.

Personal income gains accelerate in 2017, reflecting stronger growth in earnings from work; dividends, interest, and rent; and transfer payments. Accelerating earnings from work reflect both the state’s increased minimum wage and tighter labor markets. Overall, personal income gains are forecast to rise from 3.6% in 2016, to 4.8% this year, and then to 5.4% and 5.8% in 2018 and 2019, respectively.

Rising income gains drive up sales, with retail sales growth rising from 2.8% in 2016 to 3.8% this year, then just above 4.0% during 2018-2019.

Overall, Arizona is well positioned to continue to generate growth at a pace that exceeds the national average, but which also falls short of our own past history.

Exhibit 2: Arizona Outlook Summary

Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!