EBRC Research Staff

Current data releases as of 22 November 2024

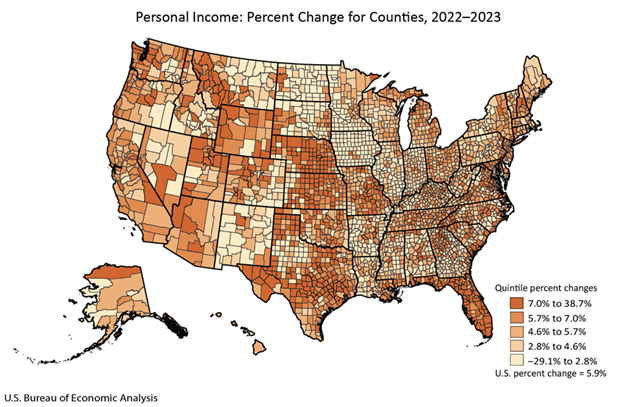

Personal income increased for the vast majority of counties in the nation in 2023 based on the U.S. Bureau of Economic Analysis’ November 14 release. Metropolitan counties experienced a bigger boost in income at 6.0% compared to 4.7% in nonmetropolitan counties. North Dakota and Texas represented the extremes in the one-year income change. Metropolitan counties ranged from -8.6% in Oliver County, ND, to 17.3% in Oldham County, TX, while nonmetropolitan counties ranged from -29.1% in Sheridan County, ND to 38.7% in Sherman County TX. Income increases in Arizona counties ranged from 2.9% in Graham County to 7.7% in Yavapai County. Per capita personal income in Arizona for 2023 was $62,543 with Maricopa County having the highest per capita income in the state with $68,111, followed by Coconino at $62,002, La Paz at $58,739, and Pima at $58,232. Graham posted the lowest per capita personal income at $42,787. – Valorie Rice

The October Consumer Price Index (CPIU) monthly increase remained at the same level for a fourth consecutive month, at 0.2%. Prices for shelter accounted for more than half of the all-items increase with a rise of 0.4% over the month. Energy prices were unchanged though the index for food increased 0.2% with food at home rising 0.1% and food away from home at 0.2%. The index for all items less food and energy increased 0.3% in October, the same amount as the previous two months. The annual inflation rate for October stood at 2.6%. 0.2 percentage points higher than in September. Core inflation (all items less food and energy) was 3.3% in October. The Phoenix CPI is available on even months, and the October 12-month price change for the metropolitan area was 1.6%. This was a percentage point lower than the nation and the lowest inflation of any metropolitan area reported in October. – Valorie Rice

Use your cursor as a tooltip and click titles on/off in the legend at the bottom of the chart to make comparisons.

The Producer Price Index rose 0.2% in October on a seasonally adjusted basis. Final demand services were the primary contributor to the monthly change, moving up 0.3% while final demand goods rose 0.1% after decreases in the last two months. Prices in portfolio management drove the increase in final demand services. Final demand goods less foods and energy rose 0.3% in October, fueled in part by an 8.4% increase in carbon steel scrap prices. The 12-month unadjusted change in final demand producer prices was 2.4%, up from 1.9% in September. – Valorie Rice

In September, over the year metropolitan unemployment rates were higher in 260 of the 389 metropolitan areas, lower in 101, and unchanged in the remaining 28. The September unemployment rate for the Tucson and Phoenix metropolitan areas came in at 3.8% and 3.4%, respectively. Yuma had the highest unemployment rate in Arizona at 14.2%, while Phoenix and Prescott ranked lowest, at 3.4%. Sioux Falls, SD, had the lowest unemployment rate at 1.4%, while El Centro, CA, had the highest rate, at 19.2%. The largest unemployment rate increase over the year occurred in Kokomo, IN, gaining +4.0 percentage points, and Kahului-Wailuku-Lahaina, HI, had the largest over-the-year decrease (-4.5 percentage points). – Delaney O’Kray-Murphy

In October, over the month state unemployment rates were higher in one state, lower in three states, and stable in the remaining 46 and the District of Columbia. Arizona’s seasonally adjusted unemployment rate increased by 0.1 percentage points over the month to 3.6%. South Dakota had the lowest unemployment rate in October, 1.9%, while Nevada and the District of Columbia had the largest unemployment rates, at 5.7% each. Twenty-four states and the District of Columbia had unemployment rate increases over the year, the largest of which was in South Carolina (+1.7 percentage points), while six states had over-the-year decreases, the largest being Connecticut (-1.2 percentage points). – Delaney O’Kray-Murphy

The September goods and services trade deficit came in at $84.4 billion, up $13.6 billion from a revised $70.8 billion in August. September exports fell $3.2 billion to $267.9 billion, and imports rose $10.3 billion to $352.3 billion. The increase in the deficit reflects an increase in the goods deficit of $14.2 billion to $109.0 billion and an increase in the services surplus of $0.6 billion to $24.6 billion. Year to date, the goods and services deficit increased 11.8%, or $69.6 billion, from the same period in 2023, with exports and imports rising 3.7% and 5.3%, respectively. The largest surpluses, in billions, occurred with South and Central America ($3.5), Netherlands ($3.2), and Hong Kong ($2.2), and the greatest deficits were with China ($26.9), European Union ($23.8), and Mexico ($16.0). – Delaney O’Kray-Murphy

In the third quarter of 2024, a family earning the national median income needed to spend 38% of its income to pay for a median-priced existing home based on the National Association of Home Builders (NAHB)/Wells Fargo Cost of Housing Index. This marked a slight increase in affordability as it required 39% of the median family income to afford a median-priced existing home in the second quarter of 2024. The share of income to afford an existing home in Phoenix for the third quarter was the same as the nation while Tucson fared a bit better with 36%. – Valorie Rice

According to the November 20th State Job Openings and Labor Turnover (JOLTS) report, job opening rates decreased in four states, increased in one state, and were little changed in all other states. The job opening rates for Arizona were 5.2% in September, 5.2% in August, and 5.1% in July. The number of job openings decreased in seven states, increased in one state, and was little changed in all other states. The largest decreases in the number of job openings were in Texas (-134,000) and Georgia (-74,000). The largest increase was in Arkansas (+23,000). Hire rates decreased in two states, increased in three states, and changed little in all other states. The hire rates for Arizona were 3.9% for September, 3.5% for August, and 4.4% for July. The number of hires decreased in two states, increased in three states, and was little changed in all others. The largest increases in hire levels were in Michigan (+41,000) and Minnesota (+17,000). The number of layoffs and discharges increased in four states and was little changed in all other states. The national layoffs and discharges rate increased +0.2 percentage points. Nationally, the number of layoffs and discharges was little changed. – Alex Jaeger

The September 2024 release of the Job Openings and Labor Turnover (JOLTS) report stated that the number of job openings in the U.S. was 7.4 million, exhibiting little change over the month but down 1.9 million over the year. The job openings rate was 4.5% for the month. The industry with the largest increase was finance and insurance (+85,000) while the largest decrease was in health care and social assistance (-178,000). The number of hires was 5.6 million for the month, with a rate of 3.5% for September, up from 3.4% in August. The number of total separations in the nation was unchanged at 5.2 million (down 326,000 over the year), with a rate of 3.3%. The number of quits trended down to 3.1 million with a decrease of 525,000 over the year and a rate of 1.9% for September. The number of layoffs and discharges was 1.8 million with a rate of 1.2%. Layoffs increased in durable goods manufacturing and decreased in state and local government, excluding education. – Alex Jaeger

Total nonfarm employment in the U.S. was basically unchanged in October with an increase of only 12,000. Over the prior 12 months, the average monthly gain in employment was 194,000 based on the U.S. Bureau of Labor Statistics November first release. Health care and government employment continued to increase while jobs in temporary help services declined. Manufacturing employment also posted a decline for the month due to strike activity. The unemployment rate for October was 4.1%, unchanged from September, though higher than a year ago when it registered 3.8%. Average hourly earnings for all employees on private nonfarm payrolls rose 13 cents, or 0.4%, for the month and was up 4.0% over the year. – Valorie Rice

Phoenix house prices rose 2.1% over the year in August based on the latest S&P CoreLogic Case-Shiller Indices. The national home price annual gain for August was 4.2%, down from 4.8% reported in the previous month. Likewise, the 20-city composite reported a 5.2% increase in August compared to 5.9% in July. New York remained at the top of the 20-city list with an annual house price gain of 8.1%, followed by Las Vegas and Chicago with increases of 7.3% and 7.2%, respectively. Portland no longer had the lowest annual change in house prices as Denver reported 0.7% (while Portland was 0.8%). Only three cities (Chicago, Detroit, and Las Vegas) posted monthly increases in house prices between July and August, and, nationally, prices lowered 0.1% for the month. – Valorie Rice

Real GDP grew at an annual rate of 2.8% in the third quarter of 2024 based on the advance estimate released by the U.S. Bureau of Economic Analysis. The third quarter increase reflected expanded consumer spending, exports, and federal government spending. Imports also increased, though they are a subtraction from GDP. Real GDP increased 3.0% in the second quarter of 2024. A second estimate based on more complete source data will be released on November 27. – Valorie Rice