George W. Hammond, EBRC director and Eller research professor

Job losses were driven primarily by service-providing sectors

Arizona jobs dropped by 3,300 over the month in May, on a seasonally adjusted basis. April job growth was revised down from 12,500 to 8,600. The seasonally-adjusted unemployment rate was steady at 3.4%, just below the national rate of 3.7%.

State job losses May were fueled by professional and business services (down 3,600), financial activities (down 2,200), information (down 1,000), construction (down 1,000), and other services (down 100).

Partially offsetting the losses were government (up 2,000), leisure and hospitality (up 1,300), private education and health services (up 500), trade, transportation, and utilities (up 300), manufacturing (up 300), and natural resources and mining (up 200).

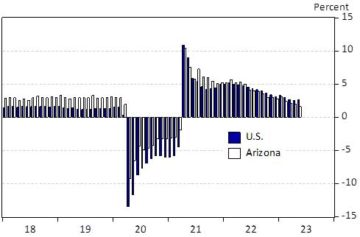

Over the year, Arizona jobs were up 48,600, which translated into 1.6% growth. That was a bit below the national average of 2.6% (Exhibit 1).

Exhibit 1: Arizona and U.S. Job Growth, Over the Year, Percent

Compared to February 2020, Arizona jobs were up 157,800 in May. Exhibit 2 shows how that job growth was distributed across industries. Trade, transportation, and utilities jobs were up 54,100 from their pre-pandemic level in May, followed by professional and business services, private education and health services, construction, manufacturing, financial activities, leisure and hospitality, and natural resources and mining.

Government jobs remained well below pre-pandemic levels in May, while other services and information were close to full recovery.

Exhibit 2: Arizona Jobs by Industry, Change From February 2020 to May 2023, Seasonally Adjusted, Thousands

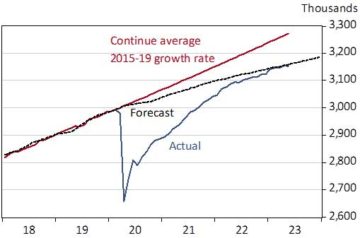

Even with job losses in May, Arizona jobs remained essentially on trend, if we take the first quarter 2020 EBRC forecast as a good representation of that trend (Exhibit 3). A higher standard for the trend would be maintaining the state’s average job growth rate during the five years before the pandemic began. By that standard, Arizona jobs were 120,600 below trend. The EBRC forecast is likely a better representation of the state’s possibilities because it accounted for demographic shifts (aging of the baby boom generation) that are impacting growth.

Exhibit 3: Arizona Jobs Relative to Trend, Thousands