Valorie Rice, Senior Business Information Specialist

Current data releases as of 20 May 2022

Annual inflation for the U.S. in April was 8.3 percent, compared to 8.5 percent in March. The Bureau of Labor Statistics provides Consumer Price Index data for select local areas, and prices rose even more in the Phoenix metropolitan area than the nation, increasing 11.0 percent over the year for April compared to 8.3 percent nationally. That was the highest inflation for all areas. The Consumer Price Index increased 0.3 percent over the month in April, compared to a boost of 1.2 percent in March on a seasonally adjusted basis. The index for all items less food and energy was up 0.6 percent for the month.

Use your cursor as a tooltip to switch series ON/OFF at the bottom of the chart. Run your cursor over the chart to view values.

Seasonally adjusted producer prices rose 0.5 percent in April, which was the smallest monthly increase so far this year. Final demand goods were up 1.3 percent for the month while final demand services were unchanged. Final demand less foods, energy, and trade increased 0.6 percent. The 12-month change in final demand price index was 11.0 percent.

Job growth in Arizona was 3.8 percent over the year for April, with all sectors but one adding more jobs than this point last year. Financial activities was the only sector with fewer jobs this April than last according to the Arizona Office of Economic Opportunity May 19 release. Over the year employment changes in Arizona metropolitan areas for April were 7.3 percent in Flagstaff, 4.9 percent in Yuma, 4.3 percent in Lake Havasu City-Kingman, 4.1 percent in Tucson, 4.1 percent in Prescott, 3.8 percent in Phoenix, and 1.2 percent in Sierra Vista-Douglas. Arizona’s seasonally adjusted unemployment rate ticked down to 3.2 percent in April, another record low.

Arizona once again was among states posting record-breaking low unemployment rates with 3.2 percent in April based on the State Employment and Unemployment report, released on May 20 from the U.S. Bureau of Labor Statistics. Nebraska and Utah had unemployment rates of 1.9 percent each, the lowest of all states for the month and new series lows for each. There were eight other states (Arizona among them) that also posted their lowest jobless rates since the series began in 1976. Arizona was among the 18 states with a seasonally adjusted unemployment rate lower than the U.S. rate of 3.6 percent. Nonfarm payroll employment increased over the year in 49 states and the District of Columbia and was basically unchanged in one state.

Compare Arizona’s Unemployment Rate to Other Western States

Arizona had the largest increase in the rate of quits for March. The seasonally adjusted quit rate for the state had steadily moved upwards for several months, with a pause in February when it lowered, then bounced back up in March, increasing 1.2 percentage points. Florida had the largest number increase of quits and separations for March, followed by Arizona according to the State Job Openings and Labor Turnover (JOLTS) data from the Bureau of Labor Statistics, released May 18. Florida also had the largest increase in the number of job openings and hires while the largest increases in job opening rates were in Arkansas and Kentucky.

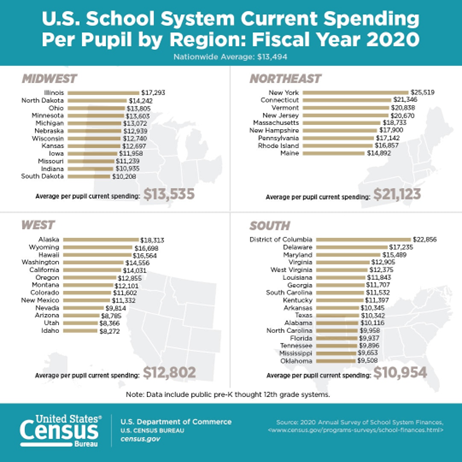

Arizona remained one of the states with the lowest per pupil spending for public elementary-secondary school systems in fiscal year 2020 at $8,785 compared to the nationwide average of $13,494. Only Utah ($8,366) and Idaho ($8,272) had lower per pupil spending than Arizona for 2020. Arizona had the lowest per pupil expenditures for instruction in the U.S., which includes salaries, employee benefits, supplies, materials, and contractual services. Per pupil spending in Arizona increased 1.8 percent in 2020, the lowest increase in spending since 2016 based on tables from the U.S. Census Bureau 2020 Annual Survey of School System Finances, released May 18. Nationally, spending increased 2.3 percent, which was the smallest increase since 2013.

There were three Arizona metropolitan areas with better housing affordability than the nation for the first quarter 2022 based on data from the National Association of Home Builders (NAHB)/Wells Fargo Housing Opportunity Index. Nationally, 56.9 percent of homes sold in the first quarter were affordable to a family earning a median income. Yuma at 69.3 percent, Sierra Vista-Douglas at 69.1 percent, and Tucson at 66.0 percent all had higher shares of homes affordable to the median family income for their areas. Below the national level were Lake Havasu City-Kingman at 51.5 percent, Phoenix at 43.9 percent, Prescott Valley-Prescott at 40.5 percent, and Flagstaff at 38.2 percent, leaving three Arizona metros with smaller than a 50 percent share of homes affordable for the local median family income. Sierra Vista and Phoenix both had a lower share of affordable homes compared to the fourth quarter 2021 while the U.S. improved. The modest gain in affordability for the nation will likely not hold according to the May 12 NAHB release. Factoring in the recent rise in mortgage interest rates, which were not reflected in the average for the first quarter, would have dropped the current affordability level to the lowest in ten years. The most affordable markets in the nation for the first quarter were Wheeling, WV-OH at 97.3 percent for small areas and Lansing-East Lansing, MI at 92.3 percent for large areas.