First Quarter 2022 Forecast Update

George W. Hammond, Ph.D., EBRC Director and Research Professor

This forecast was completed at the end of February 2022. For more timely access to forecasts contact George Hammond about access to the Forecasting Project.

Arizona’s jobs are once again breaking new ground, after regaining their pre-pandemic peak in November 2021. In addition, the state unemployment plunged during the second half of the year, as the state’s labor market tightened significantly. Nominal retail sales continued to rise rapidly through the end of the year, reflecting past income gains, rising household wealth, and rapid inflation. House prices have soared lately, as household formation increased, dragging down housing affordability. Population gains were solid last year, driven solely by net migration as natural increase dipped into negative territory.

The outlook for the state economy is positive, with the baseline forecast calling for strong job growth in 2022 and 2023 and continued solid population gains. Income and sales growth are forecast to slow in nominal terms this year and fall after adjustment for inflation. The recent surge in inflation implies more restrictive monetary policy and higher interest rates this year, which will likely contribute to slower economic growth and may raise the risk of a downturn next year.

Arizona Recent Developments

Arizona’s preliminary seasonally-adjusted unemployment rate plummeted again in December, according to preliminary estimates. The state rate has fallen from 6.8% in June 2021 to 4.1% in December, which was the lowest since December 2007. That was slightly above the national rate of 3.9% but below its February 2020 level of 4.9%. The non-seasonally adjusted state rate was 2.8%. The labor market is really tight.

While Arizona has replaced all of the jobs lost during the early months of the pandemic, the U.S. has not. Keep in mind that getting back to the pre-pandemic peak is a low bar. The state is nowhere near the number of jobs we would have had if we had remained on our pre-pandemic trend. Indeed, if the state had continued to generate jobs at the same pace recorded from 2015-2019 (0.2% per month) then employment would be 138,200 jobs higher than we observed in December.

Over the year in the third quarter, Arizona personal income rose by 3.7%, below the U.S. growth rate of 5.2%. State gains were driven by earnings from work (up 9.0%) and dividends, interest, and rent (up 3.5%). Transfer receipts were down 8.0% over the year.

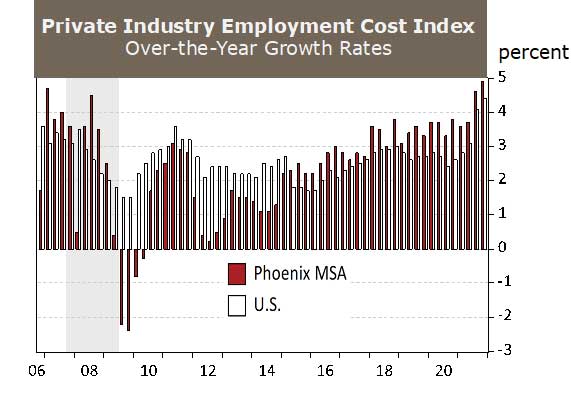

Wage gains accelerated at the end of 2021, according to data from the Employment Cost Index for the U.S. and Phoenix (Exhibit 1). For total compensation of private industry workers, the index increased by 4.9% over the year in the fourth quarter, up from 4.6% in the third. Growth in the fourth quarter was the fastest since the fourth quarter of 2006. It was also faster than national growth, which hit 4.4% over the year in the fourth quarter and 4.1% in the third. Keep in mind that the employment cost index is adjusted for shifts in employment across industries and occupations.

Exhibit 1: Phoenix Compensation Growth Accelerated at the End of 2021

In December 2021, the median house price in Phoenix hit $452,000, up 27.3% over the year. The Tucson median house price was $338,000, up 27.5%. The Phoenix Case-Shiller index (repeat sales measure) was up 32.2% over the year in November (latest data as of this writing). House prices for Phoenix, and Tucson were well above their prior peak at the end of 2021.

Housing affordability in Arizona has deteriorated significantly as house prices skyrocketed. According to data from the NAHB/Wells Fargo housing opportunity index, 54.2% of homes sold in the fourth quarter of 2021 nationally were affordable to a family making the median income. That was higher than the Phoenix rate of 44.5% but below Tucson at 58.0%. Phoenix affordability in the fourth quarter was down 20.4 percentage points over the year. Tucson affordability was down 13.2 percentage points and national affordability was down 9.0 percentage points.

Arizona housing permit activity remained strong in 2021, according to the preliminary estimates from the U.S. Census Bureau. Arizona permits totaled 64,924 in 2021, up 7.6% from the revised 2020 total, calculated using non-seasonally adjusted monthly data. The count in the model is slightly different since we use seasonally-adjusted estimates there. Single-family permits were up 9.1% and multi-family permits were up 4.0% last year. Housing permit data for 2021 will be revised later this year.

Phoenix permits hit 51,143 in 2021, up 6.0% from the revised 2020 count. Single-family permits were up 9.0% and multi-family permits were up 0.4%.

Tucson permits increased strongly last year, rising by 22.5% to reach 6,075. Single-family permits were up 20.6% and multi-family permits were up 33.9%.

Arizona Outlook

The outlook for Arizona, Phoenix, and Tucson depends in part on national economic performance. The forecasts presented here are based on U.S. projections produced by IHS Markit in January 2022. Their current forecast is based on the following assumptions:

In early 2022, a winter wave of COVID (Omicron variant) temporarily slows spending on travel and tourism services. By spring the transition from pandemic to endemic resumes as more of the population is vaccinated or previously infected. There is no repeat of the 2020 “lockdown.”

The forecast includes all of the pandemic relief enacted in 2020, as well as the American Recovery Plan ($1.9 trillion) Act. The support to incomes from these measures, which averaged $2.7 trillion (annual rate) over the first half of 2021, will drop to less than $0.5 trillion by the fourth quarter. The forecast includes the Infrastructure Investment and Jobs Act. This has a small positive impact on the forecast. The forecast does not include the “Build Back Better” reconciliation bill.

The Federal Reserve maintains its policy rate near 0% until May 2022. The Federal Reserve is assumed to tolerate inflation modestly above 2.0% after 2023 in order to establish its 2.0% target as an average rather than a ceiling.

Tariffs and trade agreements between the U.S. and China since 2017 are assumed to continue for now.

Real foreign GDP contracted by 4.7% in 2020. Growth rebounds to 5.4% in 2021 and 3.8% in 2022.

As global growth rebounds, the price of Brent crude oil recovers from $29/barrel in the second quarter of 2020 to $79/barrel by the fourth quarter of 2021. The price then eases to $67 by 2025, before resuming a gradual increase.

The baseline forecast calls for U.S. real GDP to rise by 5.7% in 2021, 4.1% in 2022 and then decelerate to 2.5% in 2023 and 2024.

Inflation gathers momentum during the near term, with an average price increase of 4.7% in 2021 followed by a deceleration to 4.2% in 2022, and 2.2% in 2023. Inflation moderates as supply-chain issues ease and workers return to the labor force.

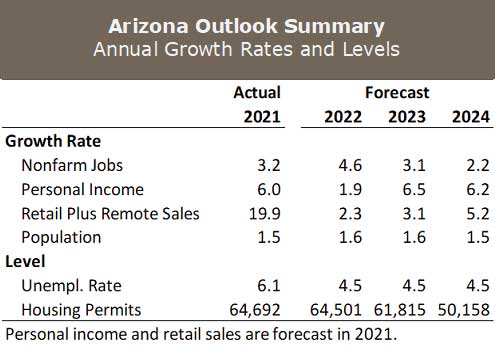

Based on the U.S. projections, the Arizona forecast calls for annual average job gains to rise from 92,300 (3.2%) in 2021 to 134,300 (4.6%) in 2022, then to decelerate to 94,700 (3.1%) in 2023 and 69,000 (2.2%) in 2024 (Exhibit 2).

Exhibit 2: Arizona Personal Income and Sales Gains Decelerate in 2022

The forecast calls for Arizona to add 650,500 jobs during the next decade, with education and health services; professional and business services; leisure and hospitality; and trade, transportation and utilities generating the most jobs. These four sectors together are projected to account for 77.5% of total state job gains.

Arizona’s population rose by an estimated 109,000 in 2021. The forecast calls for the state to add 116,300 residents in 2022, 121,900 in 2023, and 113,100 in 2024. Population gains are expected to be driven primarily by net migration, as natural increase only modestly recovers after a pandemic-driven dip into negative territory. Even so, Arizona’s population growth is expected to far outpace the U.S.

Population gains help sustain strong housing permit activity through 2023. Permits are forecast to hit 64,501 in 2022, 61,815 in 2023 before dropping to 50,158 in 2024, a level more consistent with population change.

In contrast to solid job and population gains, income and sales growth decelerates in 2022. That reflects the cessation of federal income support related to the pandemic. Nominal gains remain positive, but inflation-adjusted income and sales are expected to decline in 2022.

Phoenix drives state growth during the forecast, with gains well above the nation. Tucson expands as well, but at a much slower rate.

Risks to the Outlook

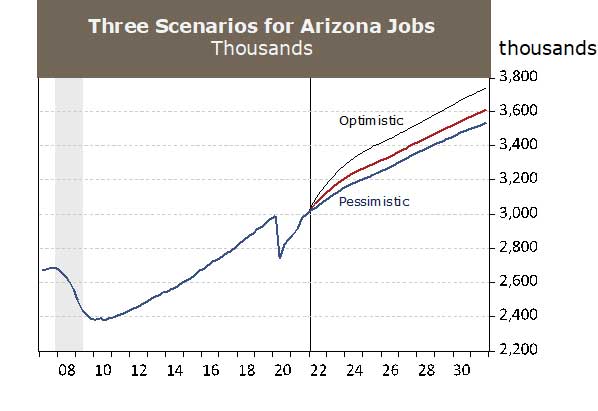

The baseline outlook calls for Arizona to generate strong job and population growth in the near term as income and sales growth decelerate. Exhibit 3 shows the state job forecasts for the baseline, pessimistic, and optimistic scenarios. The baseline outlook is assigned a 50% probability.

The pessimistic scenario is assigned a 30% probability. It assumes that the resurgence of the pandemic in the winter months prevents a rapid recovery in travel and tourism. It also assumes that supply-chain issues drag on through the year. This slows growth in consumer spending on durables. Together, these factors provide a significant drag on U.S. and Arizona growth.

The optimistic scenario (20% probability) assumes that travel and tourism recovers rapidly, supply-chain issues are resolved more quickly, and that consumers respond more positively to infrastructure spending. These factors generate stronger near-term growth.

Exhibit 3: Another Surge of the Coronavirus Drives the Pessimistic Scenario

VIEW MOST RECENT FORECAST DATA FOR ARIZONA, PHOENIX, AND TUCSON

If your business or organization requires more timely and in-depth forecast data and analysis, find out about the benefits of joining EBRC’s Forecasting Project and email EBRC director George Hammond at ghammond@arizona.edu.

Copyright 2022 Economic and Business Research Center, The University of Arizona, all rights reserved.