Fourth Quarter 2020 Forecast Update

By George W. Hammond, Ph.D., Director and Research Professor, EBRC

November 2020

The Arizona recovery continued in the third quarter, although at a much slower pace than during the April-June period. The state has received a significant boost from the CARES Act, with just over $40 billion in federal funds flowing to the state in the second quarter. That supported taxable sales and boosted the recovery in retail trade, warehousing, and transportation jobs. While construction employment rose modestly from June to October, housing permits surged, rising almost one-third over the year in the third quarter.

The outlook for Arizona remains unusually uncertain and continues to be dominated by the pandemic. The baseline forecast assumes that the outbreak recedes from summer highs, but remains elevated. It also assumes significant federal stimulus in the fourth quarter of 2020. Under these assumptions, the state is forecast to return to pre-pandemic employment levels by mid-2021. The pessimistic scenario projects a slower recovery, with the state returning to its prior peak at the end of 2021.

Arizona Recent Developments

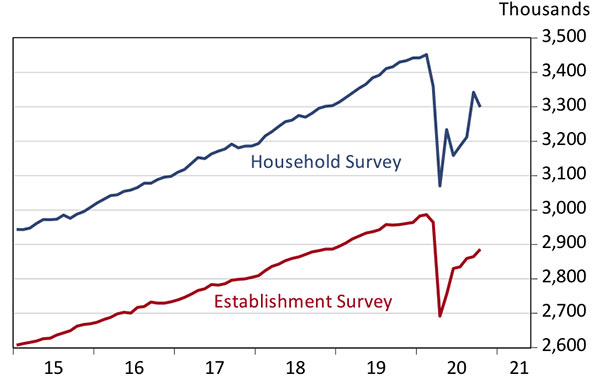

Arizona added 55,600 jobs (seasonally adjusted) from June to October. Trade, transportation, and utilities added the most jobs during the period, followed by professional and business services; government; education and health services; leisure and hospitality; construction; other services; financial activities; and information. Manufacturing jobs were stable, while natural resources and mining jobs fell slightly.

Overall, the state has now replaced 193,900 of the 294,600 jobs lost from February to April, for a 65.8% replacement rate. The nation has replaced 54.5% of the jobs lost from February to April.

Note that the state needs to add 100,700 jobs to return to pre-pandemic employment. If the state can continue to add nearly 13,900 jobs per month on average, as it has since June, then employment will be back to pre-pandemic levels next June. However, that may be a difficult pace to maintain, since over-the-month job gains averaged 6,200 during 2015-2019.

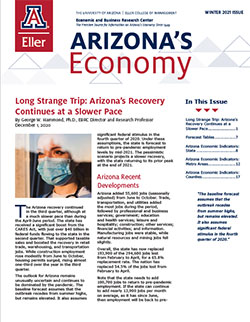

Exhibit 1 shows seasonally-adjusted employment from both the establishment and household surveys. As the exhibit suggests, we have a long way to go to replace the jobs lost during the spring.

Seasonally-adjusted employment measured by the household survey experienced a huge jump in September that was not reflected in the establishment survey. These data are always volatile during the current year and seem to be even more volatile than usual this year. This may be related to reduced survey response rates during the pandemic.

Exhibit 1: The Jobs Recovery in Arizona Has A Long Road Ahead

Employment Measured by the Establishment and Household Surveys, Seasonally Adjusted

The household survey also generates estimates of the state unemployment rate. These estimates have also been very volatile, with the seasonally adjusted state rate falling from 10.7% in July to 5.9% in August then back up to 6.5% in September and 8.0% in October.

The travel and tourism sector continues to struggle with the impact of the pandemic. As Exhibit 2 shows, leisure and hospitality jobs in October were 54,500 below February. Through October, jobs at eating and drinking places have recovered much faster than jobs in accommodation or arts, entertainment, and recreation. Employment at eating and drinking places was down 9.7% in October, compared to -29.4% and -34.3% for accommodations and arts, entertainment, and recreation.

Exhibit 2: Arizona’s Leisure and Hospitality Sector Remained Hardest Hit from February 2020 to October 2020

Thousands, Seasonally Adjusted

From February to October, jobs in professional and business services were down 18,100, reflecting losses in employment services (temporary help). These jobs are very sensitive to the business cycle.

Employment in education and health services declined by 14,700 from February to October, reflecting large declines in health care and social assistance (although education jobs were down as well). Job losses in health care and social assistance were fairly evenly distributed across social assistance, ambulatory health care, nursing and residential care facilities, and hospitals.

Two sectors posted more jobs in October than February: other services and trade, transportation, and utilities. Job gains in trade, transportation, and utilities were driven by transportation, warehousing, and utilities. Retail and wholesale trade jobs were up slightly.

Arizona’s personal income skyrocketed in the second quarter of 2020, thanks to the CARES Act. State personal income rose 11.6% over the year, driven by a 62.2% increase in transfer receipts. Net earnings by place of residence fell by 0.8% and income from dividends, interest, and rent fell by 1.3%.

According to estimates from the U.S. Bureau of Economic Analysis, the CARES Act pumped $40.2 billion into Arizona in the second quarter. The largest contribution came from the Economic Impact Payments (Recovery Rebates), which added $23.4 billion to state income. Absent CARES Act funds, Arizona’s personal income would have declined by 3.8% (or -14.4% annualized) from the first to the second quarter.

While construction jobs have weakened during the pandemic, housing permit activity has surged. Preliminary seasonally adjusted housing permit data suggest that statewide total permits were up 25.2% year to date through October compared to last year. Even so, house prices continue to rise at a rapid pace.

Arizona Outlook

The forecast for Arizona depends on global and national economic performance. The current state and local forecasts rely on the October 2020 U.S. forecast generated by IHS Markit, which was based on the following assumptions:

COVID-19 infections and deaths recede from July levels, but remain elevated. This creates stop-and-go openings by states. A vaccine is assumed to become widely available in mid-2021.

The forecast includes current federal fiscal policy actions and assumes legislation enacting a $300/week unemployment insurance supplement from October through December. Further, the forecast assumes $270 billion in stimulus checks are disbursed in the fourth quarter of 2020. As of this writing, it does not appear that this assumption will be met, which suggests that the baseline projections may be too optimistic.

The Federal Reserve maintains its policy rate near 0% until late 2026. Real foreign GDP contracts by 6.7% in 2020. Growth rebounds to 4.4% in 2021.

The current baseline forecast calls for a sharp rebound in real GDP growth in the third quarter, but the level remains well below the pre-pandemic peak. Thereafter, growth decelerates significantly as the current durable goods spending overshoot unwinds, fiscal stimulus fades out in 2021, and the pandemic accelerates this winter.

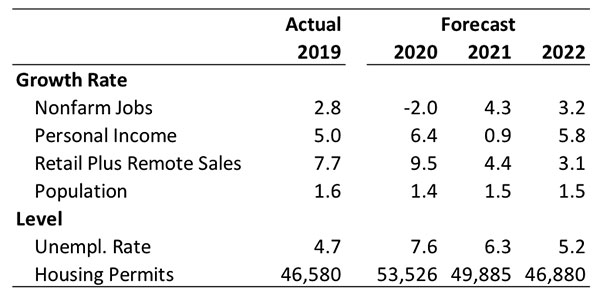

The national forecast sets the stage for Arizona’s recovery, summarized in Exhibit 3. In the baseline, state jobs are expected to decline by 2.0% in 2020, on an annual average basis. Jobs rebound in 2021, rising 4.3%, followed by 3.2% growth in 2022.

Exhibit 3: Arizona Outlook Summary

On a quarterly basis, the baseline forecast calls for Arizona jobs to return to their pre-pandemic peak in the second quarter of 2021. Keep in mind that this assumes a major federal fiscal stimulus package in the fourth quarter of 2020. The pessimistic scenario envisions a slower recovery, with state jobs reaching pre-pandemic levels at the end of 2021.

Overall, Arizona population growth is forecast to hit 1.5% in 2021 (fiscal year basis) and then gradually decelerate as the aging of the baby boom generation raises deaths while births stabilize and recover weakly.

The combination of remote sales with traditional retail beginning at the end of 2019 artificially boosts growth in the combined category in 2020. The forecast calls for growth in the retail plus remote sales sector to rise by 9.5% in 2020, then decelerate to 4.4% in 2021 and 3.1% in 2022.

The baseline forecast calls for nonfarm payroll jobs in Phoenix to decline by 2.0% in 2020, then rebound with growth of 4.0% in 2021 and 3.3% in 2022. Maricopa County generates the bulk of the job gains for the metropolitan area during the next decade. However, job gains in Pinal County are expected to be robust, in part driven by expanding auto/truck manufacturing in the county.

The Tucson metropolitan area also generates a solid recovery from the pandemic. Tucson nonfarm payroll jobs are forecast to decline by 3.2% in 2020. Growth returns in 2021 with a 3.4% increase, followed by 2.1% growth in 2022.

Risks to the Outlook

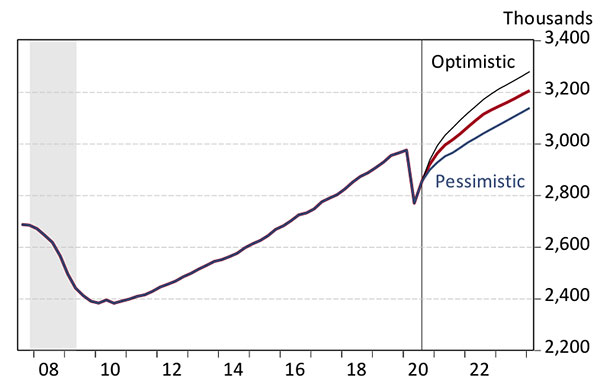

The risks to the outlook primarily revolve around the progress of the outbreak. Exhibit 4 shows three scenarios for Arizona nonfarm jobs.

The pessimistic scenario assumes that the progress of the outbreak is less controlled than under the baseline, with large negative impacts on consumer spending, particularly services. The result is a slower recovery. Under this assumption, Arizona jobs return to their pre-pandemic peak in the fourth quarter of 2021.

The optimistic scenario assumes a less threatening progression of the outbreak, with correspondingly faster gains in consumer spending. The result in this case is faster growth in the near term. Under this assumption, Arizona jobs return to their pre-pandemic peak in the first quarter of 2021.

Exhibit 4: Arizona Jobs Take Longer to Recover Under the Pessimistic Scenario

Three Scenarios for Arizona Nonfarm Jobs

Need more information about the outlook for Arizona, Phoenix, and Tucson? Email George Hammond .