By George W. Hammond, Ph.D., Director and Research Professor, EBRC

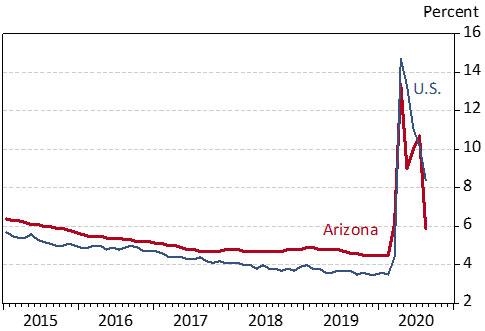

September 18, 2020 – On Thursday, the U.S. Bureau of Labor Statistics released the latest labor market data for Arizona. As Exhibit 1 shows, that data suggested a huge drop in the state unemployment rate. The preliminary estimate fell from 10.7% in July to 5.9% in August on a seasonally-adjusted basis. That put the state rate well below the national average of 8.4%.

Exhibit 1: Arizona and U.S. Unemployment Rates, Seasonally Adjusted

Unfortunately, the drop was primarily driven by a decline in the state labor force. The data suggested that a large number of unemployed residents stopped looking for work in August and thus were no longer classified as unemployed under the official (U3) definition. This is not good news.

Keep in mind that the unemployment rate data come from a survey of households each month. These data tend to be volatile during the current year. The volatility in the current year is often revised away with the benchmark revisions in the following year.

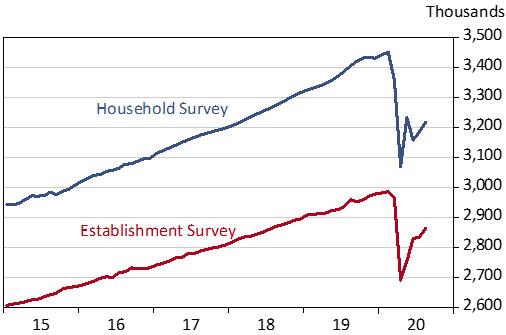

Exhibit 2 shows the employment data (seasonally adjusted) from the household survey and the establishment survey (nonfarm payroll jobs). Employment measured by the household survey is much larger than the number of jobs counted by the establishment survey because the household survey includes the self-employed and agricultural workers, which are excluded from the establishment survey.

These two measures suggest that the state labor market continued to slowly improve in August.

Exhibit 2: Arizona Employment Measured by the Household and Establishment Surveys, Seasonally Adjusted

Compare unemployment rates across Arizona metro areas and compare Arizona to other western states.

High Frequency Update 9-18-2020

Arizona initial claims for regular unemployment insurance rose modestly for the week ended September 12, to 12,756 (advance estimate). Initial claims for Pandemic Unemployment Assistance (PUA) rocketed up again to 266,224. PUA initial claims are so large and so volatile that it is unclear what conclusion (if any) to draw from the latest spike.

The Arizona Department of Employment Security reports that it has paid out $11.1 billion in unemployment compensation (state and federal funds) from early March through September 12. To put that in perspective, unemployment insurance payments during the period were 3.3% of Arizona’s total personal income last year.

U.S. initial claims for regular unemployment insurance fell for the week ended September 12, to 790,021 (non-seasonally adjusted). Initial claims for PUA fell significantly to 658,737.

The U.S. hotel occupancy rate was steady at 48.5% for the week ended September 12. That was 20.5% below year ago.

Likewise, U.S. TSA traveler throughput remained stuck around 5.0 million passengers for the week ended September 12. That was the 10th consecutive week in the 5.0 million range.

U.S. movie ticket sales rose a bit for the week ended September 10, to $30 million with the release of Tenet. That was still 78.9% below year ago. New movie releases were steady at 24.

In better news, seated diners at restaurants using the OpenTable app improved again last week for Arizona and Phoenix. Activity statewide is above mid-June and Phoenix activity is almost back to that level.

Similarly, Google Maps mobility data (to retail and recreation places) improved again for the week ended September 5 for Arizona, Maricopa County, and Pima County. This measure of activity is almost back to mid-June levels.

New business applications in Arizona for the week ended September 12 fell to 500, but remained 16.3% above year ago. The 52-week average was 6.9% above last year.

View these data on our Tracking Economic Impacts of COVID-19 webpage.