March 16, 2020 – George W. Hammond, Ph.D., EBRC director and Eller research professor

The spread of COVID-19 has created adverse economic impacts for the nation and these impacts will grow in coming weeks and months. Arizona will not escape the damage. The national economy will be in recession very soon, if it is not already. Be prepared for a major drop in the second quarter. IHS Markit, a global consulting and forecasting firm, currently expects the recession to begin in the second quarter and last through the end of 2020, with recovery beginning in 2021.

In other words, they expect a U-shaped recovery. This view is driven by their thinking on the impact of the large household wealth decline currently being driven by the stock market. With a drop of the magnitude we have seen through March 16, they expect it will take time for stock prices and consumer and business confidence to recover. They also expect that the federal fiscal policy response will be too small for the scale of the problem we are facing. This is currently a controversial point with forecasters, with some betting on a much earlier and faster rebound.

The recovery, when it comes, should be solid.

Keep in mind that there remains a large amount of uncertainty about both the future progression and economic impact of the outbreak. The near-term outlook has been changing daily and will continue to evolve rapidly. Once we know the outbreak has been fully contained, we’ll know a lot more about the recovery. It is clear that there will be difficult days ahead, but they will not last forever. Growth will return and in Arizona that growth will be stronger than average. Stay tuned.

The big adverse economic impacts began in early March with major stock market declines. The stock market is a forward-looking institution. When stock prices fall, that usually signals that traders expect the earnings of firms to drop in the future. This is the case with the recent declines in the stock market. Traders expect that the outbreak will adversely impact firm profits.

Why might firm profits decline with the spread of the virus? Think of airlines, which have seen bookings fall dramatically. Fewer airline passengers mean lower profits, which translates into lower stock prices. The same process applies to any firm/industry which depends on people gathering together in groups.

In addition, remember that stock prices can be driven by panic as well as by cold judgement. Some say that the stock trader’s motto in circumstances such as these is: “Sell first, ask questions later.”

Why do stock prices matter for the broader economy? Stocks make up a significant share of the financial wealth of U.S. residents, whether stocks are held directly or as part of workers/retirees retirement plans. When stock prices fall, people see that their wealth has declined, and people who feel poorer tend to spend less, other things the same. When consumers spend less it reverberates through the economy, with big impacts on many sectors, including retail trade jobs, consumer purchases, and sales tax revenues.

Further, the spread of the virus is creating incentives for us to increase our social distance. That means that we are being discouraged from gathering together in large groups, whether on planes, in restaurants, at arts and athletic events, or at work.

In many important ways, the leisure and hospitality sector of the economy has been and will be very adversely impacted by this trend. Leisure and hospitality includes hotels, motels, restaurants and bars, and the arts, entertainment, and recreation sectors. Similarly, the travel industry is being impacted by increased social distancing, including airlines, cruise lines, buses, and trains. Again, the outbreak will cause job losses, reduced consumer purchases, and lost sales tax revenues.

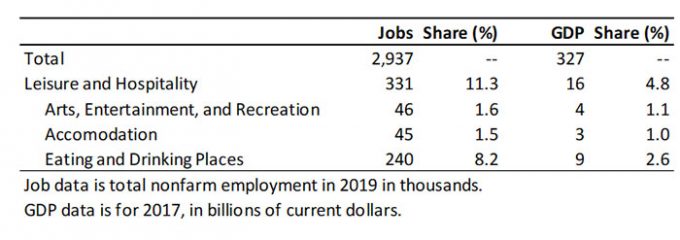

How big is the leisure and hospitality sector in Arizona? In 2019, it accounted for 11.3% of state jobs, with 331,000. Gross Domestic Product data is available only with a long lag. The latest data is for 2018, when leisure and hospitality accounted for 4.8% of GDP, at $16.6 billion. This is a large sector that will take a very large hit in the near term.

Exhibit 1 shows the Arizona employment and GDP breakdowns by industry for leisure and hospitality. Note that the GDP data is for 2017, because that is the most recent year with a detailed industry disaggregation, beyond the NAICS supersector level.

Exhibit 1: Arizona Leisure and Hospitality Industry Breakdown for Jobs and GDP

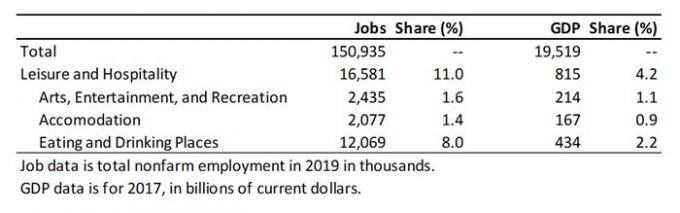

Exhibit 2 shows the same breakdown for the U.S. Leisure and hospitality is slightly more important in Arizona than for the U.S.

Exhibit 2: U.S. Leisure and Hospitality Industry Breakdown for Jobs and GDP

What about the travel sector? Air travel is an important sector in the state. In 2017, the most recent year for which data on this industry is available, air transportation GDP was $3.7 billion. According to data from the U.S. Bureau of Labor Statistics (QCEW) in 2018, the private airline sector (excluding support activities) in Arizona employed 14,000 workers. Keep in mind that this number excludes support activities for air travel (like airport operations) as well as the many travel-related industries.

In addition to the impacts of the outbreak on stock prices, consumers, and the travel and tourism sector, Arizona is also going to experience an adverse shock from international trade. As the global economy slows down, that will reduced for goods and services produced in the U.S. and Arizona.

In 2019, the value of Arizona’s merchandise exports to the world hit $24.7 billion dollars. That accounted for around 6.7% of Arizona’s GDP in 2019, ranking the state about 18th in the nation. The GDP share and rank are rough estimates because the U.S. Bureau of Economic Analysis has not yet released 2019 state GDP.

Mexico was our largest export destination last year, with $8.2 billion, accounting for roughly one-third of the total. Canada was our second largest destination at $2.1 billion, followed by China at $1.1 billion.

There has been and will be a major shock to global supply chains, which may make it harder for Arizona firms to produce and sell goods and services. This is harder to pin down quantitatively, but the negative impact will be felt as we move forward.