Fourth Quarter 2019 Forecast Update

By George W. Hammond, Director and Research Professor, EBRC

The Arizona economy is on pace to post another year of strong growth. Job gains in Arizona are robust, supporting solid increases in wages, incomes, and taxable sales. Across the state, Phoenix is producing most of Arizona’s growth, but Tucson appears to be gaining momentum. Overall, the state economy is generating robust growth that is far outpacing the national average.

Arizona’s strong gains are underpinned by solid national economic performance. While the U.S. is expected to continue to expand in the near term, risks to the outlook have increased during the past year. Slowing global growth, decelerating consumer spending, tariff and trade uncertainty, and approaching capacity constraints suggest a softer pace of economic activity in 2020 and 2021. Decelerating growth raises the risk that unexpected events or policy mistakes might tip the economy into a downturn. If the U.S. falls into recession, that will translate into slower gains or moderate declines in economic activity in Arizona.

Arizona Recent Developments

Arizona generated strong increases in employment in the third quarter of 2019, adding 72,100 jobs over the year. That translated into 2.5% growth, which comfortably outpaced the nation at 1.5%. Most of Arizona’s job gains (75.4%) came in four industries: education and health services (up 20,100 jobs over the year); construction (up 16,500); manufacturing (up 9,200); and trade, transportation, and utilities (up 8,600).

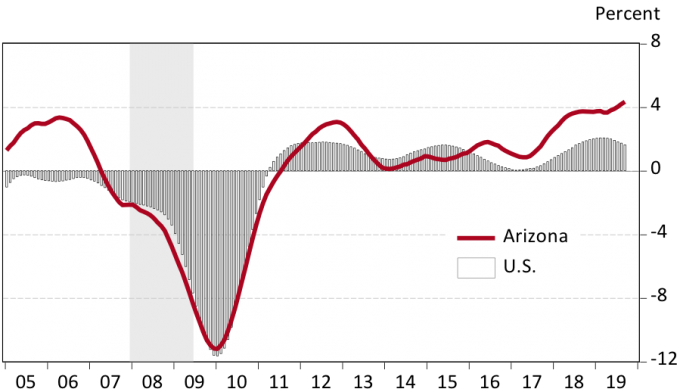

Arizona manufacturing job gains have been accelerating while at the national level they have been losing steam, as Exhibit 1 shows. Manufacturing employment increased 5.4% over the past year. That far outpaced anemic national gains of 1.0%. By this measure, Arizona’s manufacturing job growth ran at the fastest pace since mid-1995, about 24 years ago.

Exhibit 1: Arizona Manufacturing Job Growth Accelerated, While the U.S. Slowed

Over-the-Year Growth Rates, Smoothed

Rising construction employment in Arizona reflected gains in housing permits. After a weak start to the year, housing permits rebounded strongly. Through the first nine months of the year, statewide total permits were up 6.6% over 2018. Gains in both single-family (6.3%) and multi-family (7.2%) activity contributed to the increase.

Arizona house prices continued to rise at a rapid pace in the second quarter of 2019. Over-the-year growth in the FHFA All-Transactions index was 7.2%, compared to 5.0% for the U.S. Arizona’s growth has exceeded the nation for 17 straight quarters, or since the second quarter of 2015 (Exhibit 3).

The U.S. Bureau of Economic Analysis (BEA) released new and revised data for personal income and the news was good. Estimates for recent years showed significantly stronger growth. State total personal income was revised up by 0.5% in 2016, 1.0% in 2017, and 1.6% in 2018. Current estimates suggest that state personal income rose 6.1% last year, before adjustment for inflation. That was faster than the nation at 5.6%.

Per capita personal income in Arizona rose 4.3% in 2018, again before adjustment for inflation, but that was below the national pace of 4.9%. That caused the state income gap with the nation to rise to 18.6% or, alternatively, that Arizona’s per capita personal income was 81.4% of the nation.

Strong income growth so far this year translated into solid performance in taxable retail sales, which was up 7.1% during the first eight months of the year, compared to the same period in 2018. Taxable sales at restaurants and bars also posted solid gains so far this year, up 6.0% over the same period in 2018.

Arizona Outlook

The Arizona forecast depends on projections for U.S. and global growth, which come from IHS Markit and were completed in October 2019.

The U.S. forecast calls for continued growth under baseline assumptions. Real GDP growth is projected to fall from 2.9% in 2018 to 2.3% this year and then to 2.0% in 2020 and 2021. This implies that the national economy is expected to decelerate from above trend gains in 2018 to trend growth rates by 2020. Driving the slowdown are weakening global growth, softening consumer spending, tariff and trade uncertainty, and approaching capacity constraints.

The interest rate spread has garnered a lot of attention from analysts lately, because some (not all) spreads turned negative this year. That is normally a sign of slowing growth and eventually a recession.

One important interest rate spread is the difference between the 10-year U.S. Treasury rate and the two-year U.S. Treasury rate. That spread turned negative (the two-year rate above the 10-year rate) in June. In October it rose to positive territory again. This does not invalidate the prior signal because negative interest rate spreads often turn positive before the downturn begins.

Another important interest rate spread is the difference between the 10-year U.S. Treasury rate and the three-month rate. This spread never ventured into negative territory.

The bottom line as of this writing is that bond markets are sending a distinct, but not especially strong, signal of slowing growth.

The baseline U.S. outlook sets the stage for continued gains in Arizona as well. The state is forecast to generate 75,700 net new jobs this year for 2.7% growth. That is slightly slower than the 2.8% rate last year. As the U.S. economy slows, so does Arizona, with job growth slipping to 2.3% in 2020 and 1.7% in 2021 (Exhibit 2).

Over the next decade, most new jobs are expected to come in service-providing sectors. Gains are forecast to be concentrated in education and health services; professional and business services; leisure and hospitality; and trade, transportation, and utilities. These four sectors account for 79.0% of job growth during the next decade.

Exhibit 2: Arizona Outlook Summary

| Actual | — Forecast — | |||

| 2018 | 2019 | 2020 | 2021 | |

| Growth Rate | ||||

| Nonfarm Jobs | 2.8 | 2.7 | 2.3 | 1.7 |

| Personal Income | 6.1 | 5.9 | 5.7 | 5.4 |

| Retail Sales Less Food | 7.0 | 6.1 | 4.6 | 3.5 |

| Population | 1.6 | 1.5 | 1.5 | 1.4 |

| Level | ||||

| Unemployment Rate | 4.8 | 4.9 | 4.5 | 4.4 |

| Housing Permits | 41,664 | 44,997 | 43,841 | 43,495 |

| Source: The Forecasting Project, Economic and Business Research Center, Eller College of Management, The University of Arizona | ||||

Weaker increases in employment translate into lower income and population gains. Income growth gradually decelerates from 6.1% in 2018 to 5.4% by 2021, before adjustment for inflation. Population growth slows from 1.6% last year to 1.4% in 2021.

In turn, softening income growth translates in to decelerating taxable retail spending, which slows from 7.0% last year to 3.5% by 2021.

Housing permits increase in 2019 then stabilize between 43,000 and 44,000 permits per year, as population gains stabilize.

Even though economic performance in Arizona is forecast to decelerate, the pace of state gains is projected to far exceed the national average.

Risks to the Outlook

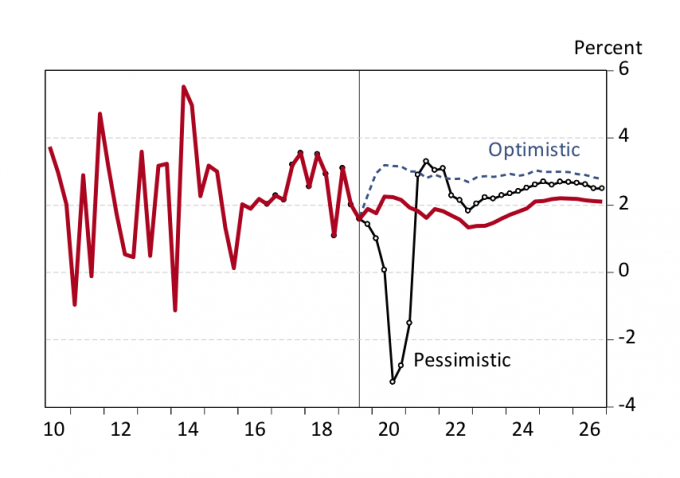

The baseline (most likely) scenario calls for continued national and state growth in the near term. However, risks to the outlook have increased during the past year. Slowing global growth, decelerating consumer spending, tariff and trade uncertainty, and approaching capacity constraints suggest a slower pace of economic activity in 2020 and 2021. Decelerating growth raises the risk that unexpected events or policy mistakes might tip the economy into recession. The pessimistic scenario from IHS Markit assumes a broad loss of confidence the hits investment and consumer spending next year. The result is a moderate, three-quarter U.S. recession that begins in the third quarter of 2020 (Exhibit 3).

While downside risks are paramount at this time, the nation could also outperform the baseline projections. IHS Markit assumes that this would be driven by stronger productivity growth, paired with a more inflation-resistant labor market and a higher equilibrium real interest rate. All of this allows the economy to run hotter without sparking inflation.

A national downturn would generate significantly slower growth in Arizona in the near term, generating modest job losses. This would likely be a much milder downturn than the Great Recession. In turn, faster U.S. growth than expected in the baseline would generate stronger gains in Arizona as well.

Exhibit 3: Alternative Scenarios for U.S. Real GDP Growth

IHS Markit, October 2019

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!