Third Quarter 2019 Forecast Update

By George W. Hammond, Director and Research Professor, EBRC

After a strong performance in 2018, the Arizona economy continues to impress. Job, income, and sales growth remain strong, well above the national pace. The Phoenix Metropolitan Statistical Area (MSA) remains the engine of state gains, but Tucson is contributing as well. The national economy is now likely in the midst of the longest expansion on record. We will not know for sure until the next recession begins and the National Bureau of Economic Research chooses the exact month when the economy peaked.

Recession risks have risen significantly during the past year, as the global economy slowed, trade fears spiked, and interest-rate spreads declined (with some turning negative). At this point, the risks of recession seem concentrated on 2020. If the U.S. economy falls into recession, that will drag Arizona down as well.

The long-run outlook for the state remains bright, even though growth is expected to decelerate. Job, population, and income gains in Arizona and Phoenix are expected to outpace the nation during the next 30 years. Tucson’s growth is expected to be at, or a bit better than, the national pace. Demographic factors are at the root of Arizona’s (and the nation’s) growth slowdown, as the baby boom generation continues to retire in large numbers.

Arizona is forecast to make some progress in closing the per capita income gap with the nation during the next 30 years. However, the gap is expected to remain large. Arizona will need to significantly improve its ability to attract and retain highly educated workers to drive the gap further down.

Arizona Recent Developments

Arizona continued to post impressive job growth through the first half of 2019, according to preliminary data. Arizona’s over-the-year job growth has been well above the nation since 2014. In the second quarter of 2019, Arizona added 76,600 jobs over the year. That translated into growth of 2.7%, similar to the pace in the first quarter of 2.6% and well above the national rate of 1.6%. The Phoenix MSA, which includes Maricopa and Pinal counties, added 66,100 jobs over the year in the second quarter, for 3.2% growth. Tucson produced solid gains, adding 6,700 jobs for 1.8% growth.

Construction job growth accelerated markedly in recent years. In the second quarter of 2019, Arizona construction jobs rose by 12.2% over the year, which was the fastest pace since 2006. Growth has accelerated across the state since 2015, with Phoenix, Tucson, and the rest of the state posting accelerating gains.

Rising construction jobs reflect in part increased residential building. According to revised data from the Census Bureau, Arizona housing permits rose 5.6% last year, with a 14.4% increase in single-family permits offset somewhat by a 16.3% decline in multi-family activity. Activity in the Phoenix MSA was up 6.9% last year, driven by a 14.9% increase in single family permits. Multi-family permits were down 11.6%. In Tucson, permit activity declined by 2.0% last year, after very strong results in 2017. Single-family permits increased 12.2% in 2018, while multi-family permits declined by 27.6%.

Arizona Outlook in the Short Run

The Arizona outlook depends in part on the global and national forecast. The U.S. economy (through July) is likely in the midst of the longest expansion on record. Even so, over the past year the U.S. outlook has darkened with elevated recession risks.

The baseline forecast (from IHS Markit) for real Gross Domestic Product (GDP) growth calls for slowing in the near term, with a gradual deceleration from above-trend performance in 2018 to below-trend performance by 2022. This forecast calls for the U.S. to avoid recession. However, it is important to keep in mind that the IHS Markit assessment of the risks of recession have increased from 20% a year ago to 35% today.

One important indicator of the future pace of economic activity is the yield curve. This shows the difference between long-term and short-term interest rates. The yield curve can be represented many ways, but two popular choices among analysts are the 10-year Treasury rate minus the three-month Treasury rate and the 10-year Treasury rate minus the two-year Treasury rate. If the long-term rate falls below the short-term rate, that is considered a signal that growth is likely to slow in the next 12-18 months.

These two interest rate spreads are currently sending conflicting signals. The spread between the 10-year and two-year rate remains positive (0.22 percentage points in July), but the spread between the 10-year and three-month rate turned negative in June and was -0.09 percentage points in July. Keep an eye on these two indicators going forward.

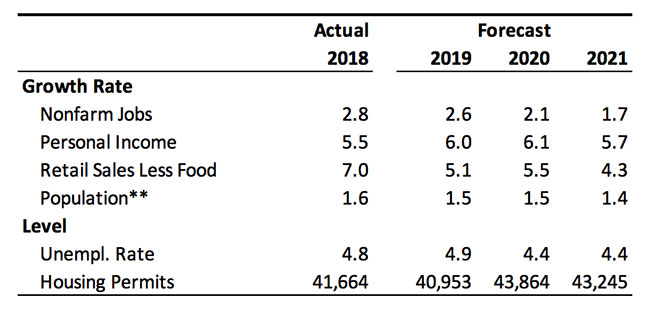

The national outlook sets the stage for slowing economic performance in Arizona. As summarized in Exhibit 1, state job growth slows from 2.8% last year to 2.6% in 2019, then to 2.1% and 1.7% in 2020 and 2021, respectively. Even slowing job gains are enough to drive the state unemployment rate down to 4.4% by 2021.

Exhibit 1: Summary of the Arizona Short-Run Outlook

Arizona Outlook in the Long Run

The 30-year outlook for the national economy calls for positive but decelerating growth. Demographics drive the slowdown, as the baby boom generation continues to retire in large numbers. That puts downward pressure on output, job, and income gains. It also puts downward pressure on natural increase (annual difference between births and deaths), which reduces population growth.

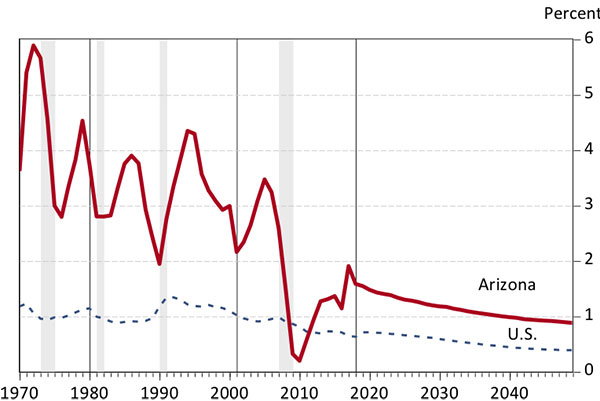

Exhibit 2 shows the latest forecast for Arizona and U.S. population growth. Gains in Arizona are expected to decelerate to 1.1% per year during the 2019-2049 period, down from 2.4% per year during 1988-2018, but above the expected national rate of 0.5% per year. In raw numbers, Arizona is forecast to add 2.8 million net new residents during the next 30 years, with population reaching 10.0 million by 2049.

Exhibit 2: Arizona and U.S. Population Growth Slows

Annual Growth Rates

Arizona job growth is forecast to average 1.4% per year during the next 30 years. That is well above growth for the nation at 0.6% per year. Note that Arizona’s job growth is expected to outpace population gains, which drives up the job-population ratio during the forecast. This implies a gradual tightening in the state labor market.

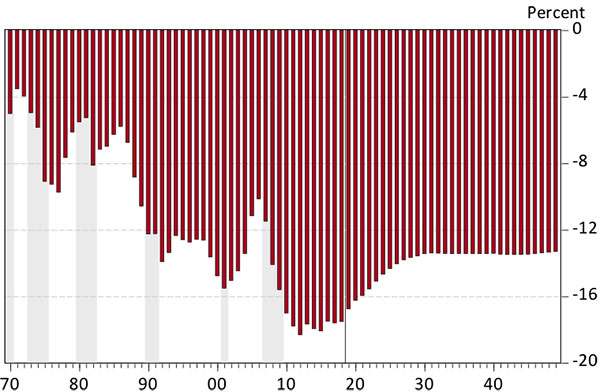

Job growth, combined with a rising job-population ratio, means that wage growth will continue. That sets the stage for solid income gains relative to the nation. Exhibit 3 shows the Arizona per capita personal income gap with the U.S. In 2018, Arizona per capita personal income was 18.7% below the U.S. The forecast suggests that the state will make some progress in driving the gap down during the next 30 years. By 2049, the gap is forecast to be 13.3%. Arizona is unlikely to eliminate the income gap with the U.S. unless the state can attract and retain significantly more four-year college graduates in the future.

Exhibit 3: Arizona’s Per Capita Income Gap with the U.S. Declines

Percentage Difference Between Arizona and U.S.

Risks to the Outlook

While the baseline forecast calls for the U.S. to avoid recession in the near term, it is important to consider alternative scenarios. Recession risks have risen significantly during the past year, as the global economy slowed, trade fears spiked, and interest-rate spreads declined and some turned negative. IHS Market has increased its assessment of recession risks (pessimistic scenario) from 20% a year ago to 35% today.

These scenarios have similar implications for Arizona. If the national economy falls into recession, it will adversely impact Arizona, likely generating a moderate downturn in the state. If the U.S. economy grows significantly faster than expected under the baseline assumptions, then Arizona is likely to perform better as well.

There are longer run risks to the state outlook as well. These include demographic risks related to the aging of the baby boom generation. If this demographic transition generates less natural increase than assumed in the baseline, that will mean even slower population growth. In turn, that will slow Arizona’s overall economic growth. In addition, human capital concerns remain important. Arizona has been gradually losing ground to the nation in the share of four-year college graduates in the working age population. This is a risk to long-run growth, particularly as trends toward increased automation (which favor highly-educated workers) seem to be progressing rapidly. Further, infrastructure will matter for the state’s future growth. Key investments in highways and roads, water and sewer, air transport, telecommunications, and border ports will be necessary. Finally, natural resources, principally water, will need to be carefully monitored and managed to accommodate future growth.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!