Arizona’s First Quarter 2019 Forecast Update*

By George W. Hammond, Ph.D. Director and Research Professor, EBRC March 1, 2019

While concerns about the future are building, current economic performance in Arizona remains strong. Very strong. After robust job gains in the third quarter of 2018, Arizona accelerated again according to preliminary estimates. State growth rose from 3.0% in the third quarter to 3.4% in the fourth quarter, which was the fourth consecutive acceleration. In addition, income and population gains remained solid, well above national results.

The outlook calls for Arizona and the U.S. to continue expanding in the near term, although growth decelerates from the torrid pace set recently. The national slowdown is driven by dissipation of the federal fiscal stimulus, the lagged impacts of past interest rate increases, uncertainty about the resolution of trade disputes, and decelerating global economic performance. While recession risks are low this year, 2020 is another story altogether. Slower national gains will weigh on Arizona’s growth in the near term. Further, a decelerating national economy will translate into elevated risk of recession in 2020 for Arizona as well.

Arizona Recent Developments

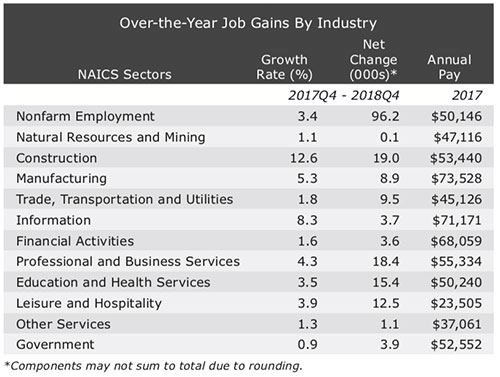

Let’s start with labor market developments. Arizona generated strong job gains in the fourth quarter of 2018, with employment increasing by 96,200 over the year according to the preliminary data. That translated into growth of 3.4%, which far outpaced the U.S. at 1.7%. As Exhibit 1 shows, most of the job growth was driven by construction, professional and business services, education and health services, and leisure and hospitality. These four sectors alone accounted for 67.8% of net job gains over the year. Note also that manufacturing added jobs at a solid clip. That is encouraging because those jobs tend to pay relatively high wages.

Exhibit 1: Arizona Job Gains Were Strong in the Fourth Quarter Over-The-Year Job Gains By Industry

Employment in the Phoenix Metropolitan Statistical Area (MSA) also increased rapidly in the last quarter of 2018, rising by 3.8%, or 79,400 jobs. That was more than double the national pace. In addition, the Tucson MSA added jobs at a rapid clip in the fourth quarter, with 10,300 net new jobs. That translated into an over-the-year growth rate of 2.7%.

Statewide total housing permits were up 5.3% over the year through November 2018, according to preliminary data. Single-family permits drove the gains (up 10.1%) because multi-family permits fell 6.0%. Phoenix MSA total permits were up 9.0% through November, with single-family permits rising by 11.5% and multi-family permits rising by 3.2%. Tucson MSA housing permits were down 5.8% through November, with multi-family activity driving the losses. Multi-family permits are down from very high levels in 2017. In contrast, single-family permits were up 14.0%.

According to the latest population estimates from the Arizona Office of Economic Opportunity, Arizona’s population hit 7,076,199 on July 1, 2018. The state added 110,302 residents from July 2017 to July 2018, which translated into a growth rate of 1.6%. That was slightly faster than the method-consistent rate of 1.5% in 2017. As usual, Arizona population growth far outpaced the U.S. at 0.7%.

Arizona Outlook

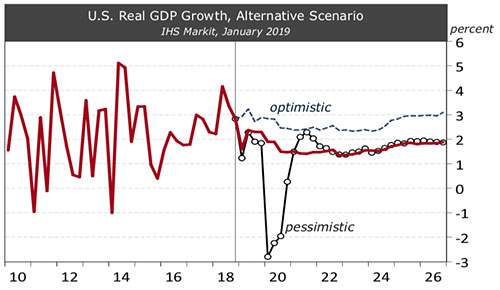

While concerns about the durability of the U.S. expansion abound, current performance remains solid. The January IHS Markit baseline forecast calls for real GDP growth to decelerate from 2.9% in 2018 to 2.5% in 2019, then to 2.0% in 2020. That forecast boils down to gradual deceleration from above-trend growth in 2018-2019 to trend growth by 2020.

Slowing growth this year is driven by the dissipation of the federal fiscal stimulus, the lagged impacts of past interest rate increases, uncertainty about the resolution of trade disputes, and decelerating global economic performance.

Interest rate spreads have been gradually narrowing during the expansion. While long-term rates are normally above short-term rates, this relationship is sometimes reversed during periods of monetary tightening. This is known as yield-curve inversion and when it happens, recessions often follow. We are nearing such a situation. In January 2019, 10-year Treasury rate was 0.29 percentage points above the three-month rate. The 10-year rate was 0.17 percentage points above the 2-year rate. Stay tuned to these indicators.

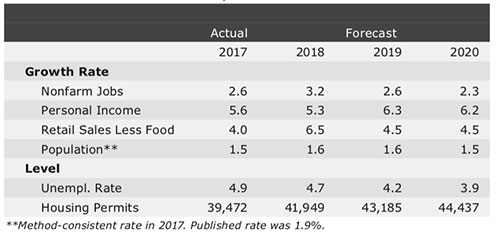

Overall, the national outlook sets the stage for continued gains in Arizona. As Exhibit 2 shows, job growth in Arizona is forecast to decelerate from 3.2% in 2018 to 2.6% in 2019 and 2.3% in 2020. Note that the forecast for 2018 incorporates EBRC’s rolling benchmark, which suggests stronger gains than the preliminary data.

Exhibit 2: Summary of the Arizona Outlook

Construction jobs rise in the near term, reflecting in part increased residential building. Arizona housing permits are forecast to rise from 41,949 in 2018 to 44,437 by 2020.

The Phoenix MSA drives state job gains during the forecast, adding 197,000 new jobs from 2017 to 2020. Tucson MSA also contributes during the three-year period, adding 18,500 jobs.

Solid increases in employment, combined with tightening labor markets and a rising minimum wage, support continued wage and income growth. Personal income rises by 6.3% in 2019 and 6.2% by 2020. In turn, expanding income drives household spending, although retail sales gains are expected to soften after strong results in 2018.

Arizona population continues to expand, as robust labor market performance attracts migrants from other states. Natural increase (births minus deaths) remains weak as the aging of the state’s population takes its toll.

Risks to the Outlook

While the U.S. baseline outlook calls for continued growth, we should consider alternative scenarios. Given recent concerns about the ability of the U.S. economy to keep growing, let’s start with the pessimistic scenario. This story assumes two main sources of trouble. The first is real estate prices, which are assumed to turn slowing growth into outright declines. This damages consumer confidence and household spending pulls back. Further, an inverted yield curve hurts business confidence, resulting in falling stock prices and reduced nonresidential investment. Overall, the pessimistic scenario generates a moderate three-quarter recession beginning in the first quarter of 2020 (Exhibit 3).

Exhibit 3: Alternative Scenarios for U.S. Real GDP Growth IHS Markit, January 2019

On a brighter note, the optimistic scenario assumes faster productivity growth, combined with a less inflation-prone labor market and an economy more tolerant of rising interest rates. This allows faster U.S. growth to be consistent with low inflation. The result is stronger overall economic performance, with real GDP growth 1.1 percentage points above the baseline during the next decade (Exhibit 3).

Arizona’s growth depends in part on national economic performance. If the U.S. falls into recession, that will generate slower growth or a downturn in the state economy. A national downturn of the sort envisioned under the pessimistic scenario would not generate a severe drop in economic activity in Arizona. In a similar vein, stronger U.S. performance would translate into a more robust state economy.