Arizona’s First Quarter 2018 Economic Outlook Update*

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

April 1, 2018

The Arizona economy lost some momentum at the end of 2017, with job growth just below the national rate. Even so, the state continues to expand, adding jobs, residents, and income, although the pace is not impressive. The Phoenix metropolitan statistical area (MSA) continues to be the engine of growth for the state, although the Tucson MSA is contributing as well.

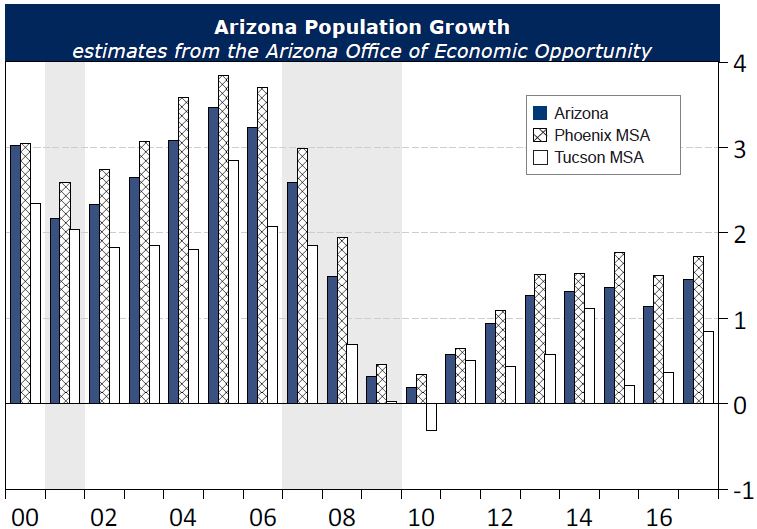

The Arizona Office of Economic Opportunity has released their latest population estimates. These data suggest continued solid population gains. Using consistent methods, Arizona’s population growth was 1.5% last year. Phoenix added residents at a slightly faster pace, 1.7%, while Tucson’s growth was slower, at 0.8%.

As long as the national expansion continues, Arizona is likely to sustain positive growth at rates similar to those we have seen during the recovery so far. National real GDP growth is expected to accelerate modestly this year and next and that will contribute to slightly stronger growth in Arizona as well. Overall, the state remains well positioned for growth.

Arizona Recent Developments

According to the latest population estimates from the Arizona Office of Economic Opportunity, Arizona’s population hit 6.966 million in 2017. The release this year reflects an adjustment to their estimation methodology, which means it is not directly comparable to previous estimates. Using a comparable method for 2016, they estimate that the state added 99,700 residents last year, for 1.5% growth. As Exhibit 1 shows, that’s similar to recent growth. Estimates for the Phoenix metropolitan statistical area (MSA) suggest population growth of 78,900 residents, a 1.7% increase, with the Tucson MSA adding 8,600 residents, a 0.8% increase.

Exhibit 1: Arizona Population Growth Remains Steady

Arizona’s job growth remained subdued in the fourth quarter, according to preliminary estimates. The state added 38,400 jobs over the year in the last quarter of 2017. That translated into 1.4% growth, which was slightly below the rate in the third quarter. It was also below the national pace of 1.5% in the fourth quarter.

The Phoenix MSA added 38,400 jobs over the year in the fourth quarter, for 1.9% growth over the year. According to preliminary estimates, which will be revised up in March, the Tucson MSA lost 1,500 jobs over the year in the fourth quarter, for -0.4% growth.

Housing permit activity was on the increase in Arizona last year, as Exhibit 4 shows. According to preliminary Census data, Arizona total housing permits were up 6.8% in 2017. That increase was concentrated in single-family permits (up 11.4%). Multi-family permits fell 3.9%.

Phoenix MSA housing permits increased 5.2% in 2017. Single-family activity drove the increase (up 12.3%), while multi-family permits declined by 7.8%.

The U.S. Bureau of Economic Analysis has released new personal income data for local areas for 2016. Personal income includes net earnings from work; dividends, interest, and rent; and transfer payments. As Exhibit 5 shows, the new estimates show continued slow gains in personal income for the Phoenix and Tucson MSAs. Phoenix MSA personal income rose by 4.0% in 2016, slightly above the state rate of 3.6%, and well above Tucson’s growth of 2.4%.

Phoenix MSA per capita personal income increased by 2.4% in 2016, just below the state rate of 2.5%, but above Tucson’s rate of 2.0%. With U.S. inflation at 1.3% in 2016, Arizona, Phoenix, and Tucson generated increased real per capita income, although the pace was slow. That indicates a rising standard of living for residents.

However, per capita income in Arizona remained well below the national average. In 2016, Arizona’s per capita income was 16.8% below the U.S. Per capita income in the Phoenix MSA was 12.2% below the U.S., while the Tucson MSA was 19.5% below the nation. For each region, low earnings from work accounted for most of the income gap.

Arizona Outlook

The state outlook depends in part on national economic performance. If national growth speeds up, that tends to generate faster growth in Arizona, other things the same. The current national forecast comes from IHS Markit and was completed in January 2018. The forecast calls for the national economy to accelerate in 2018, with real Gross Domestic Product (GDP) growth hitting 2.7%. That would be well above growth in 2016 and 2017, at 1.5% and 2.2%, respectively.

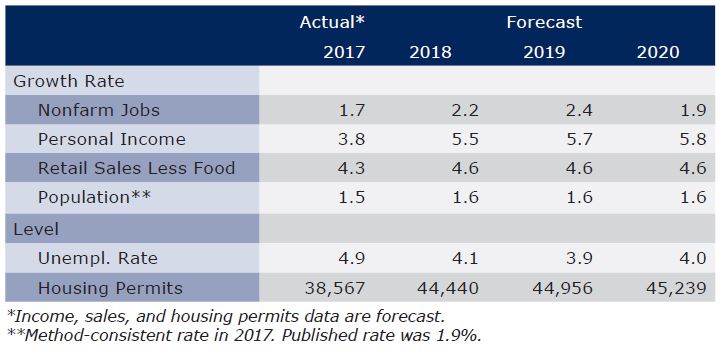

Continued national growth translates into continued gains in Arizona. The forecast calls for state job growth accelerate modestly to 2.2% in 2018, from 1.7% last year (Exhibit 2). That would put Arizona job growth above the national average, but well below average growth during the 30 years before the Great Recession.

Exhibit 2: Arizona Outlook Summary

Phoenix job growth is forecast to accelerate from 2.2% last year to 2.7% in 2018 and 2019. Tucson is forecast to generate job growth of 1.1% in 2017, with an acceleration to 1.3% in 2018 and again to 1.4% in 2019.

Sustained job gains in Arizona contribute to wage and income growth during the forecast. The forecast calls for income to rise by 3.8% in 2017, then accelerate to the 5.5%-5.8% range during the next three years. Tightening labor markets, and continued increases in the state minimum wage, contribute to faster wage and income growth.

Job gains also fuel increased net migration into the state. In turn, this is enough to modestly boost population growth from (method-consistent) 1.5% in 2017 to 1.6% per year during the next three years.

Population growth contributes to rising housing permit activity, which rises into the 45,000 permits per year range by 2020, where it stabilizes.

Overall, if the U.S. economy continues to grow, Arizona is likely to generate sustained gains in jobs, income, and population at rates above the national average. However, state growth is not likely to return to average rates experienced during the 30 years before the Great Recession.

Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!