By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

The Arizona economy slowed during the fourth quarter of 2016, with jobs rising very little over the year. Job growth was down from third quarter performance and even slower than national gains. New population estimates from the Arizona Office of Economic Opportunity suggest continued slow population increases statewide and in the Phoenix and Tucson metropolitan statistical areas (MSAs). Further, Arizona’s merchandise exports to the world (and to Mexico) declined last year.

Overall, the Arizona economy continues to expand and the prospects for somewhat stronger growth are on the horizon. A modest acceleration of the U.S. economy will help push Arizona’s gains up during the next two years, but it is important to keep the risks in mind at this point. There is currently a high degree of uncertainty surrounding federal tax, trade, immigration and regulatory policy. Further, there is uncertainty about the ultimate impact of Arizona’s new minimum wage requirements. As this uncertainty gradually clears in coming months and years, we will have a better idea of the possible impacts. Stay tuned.

Arizona Recent Developments

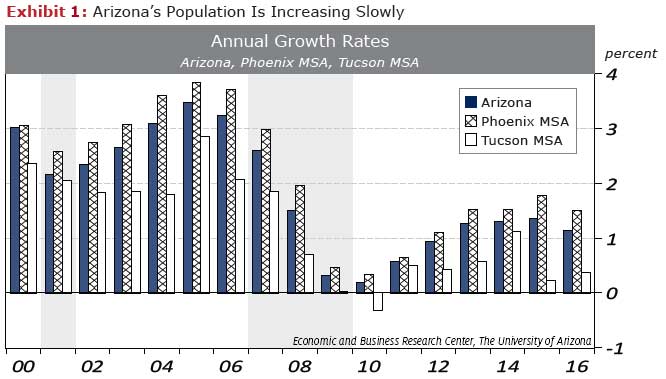

The Arizona Office of Economic Opportunity released population estimates for 2016 late last year. The data for Arizona show continued slow growth, with a net population increase of 77,300 residents in 2016. That translated into 1.1% growth, which was above the national rate of 0.7%, but below the state’s pace in 2015 of 1.4% (Exhibit 1). Keep in mind that during the 30 years before the Great Recession, Arizona’s population growth averaged 3.2% per year.

Population gains were also positive, but sluggish, for the Phoenix MSA and the Tucson MSA. Population increased by 67,500 last year in the Phoenix MSA, which accounted for 87.3% of state growth. Phoenix MSA population growth decelerated from 1.8% in 2015 to 1.5% last year. That was well above the national pace, but during the 30 years before the Great Recession, the Phoenix MSA averaged much faster population growth of 3.6% per year. In contrast, population gains in the Tucson MSA accelerated slightly last year, rising from 0.2% in 2015 to 0.4% in 2016. Overall, the Tucson MSA added 3,700 residents, which accounted for 4.8% of state gains. Tucson growth remained below the national average and well below average population growth during the 30 years before the Great Recession of 2.4% per year.

International developments continue to impact the state. The U.S. dollar surged upward in the fourth quarter against many currencies. Over the year in December 2016, the dollar was up 1.6% against major currencies and 4.5% against a more broadly based index that includes the currencies of developing countries. This continues a trend that began around the middle of 2014. Indeed, since June 2014, the dollar has risen by 24.8% against major currencies and against the broad index.

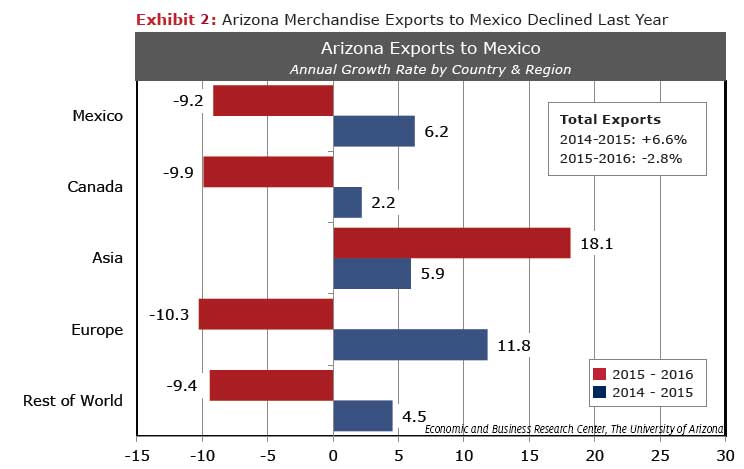

When the U.S. dollar appreciates, it puts downward pressure on U.S. exports (and upward pressure on imports), other things the same. Indeed, U.S. nominal exports of goods declined by -7.4% in 2015 and -2.9% in 2016. Arizona exports are exposed to the same pressure. After rising by 6.6% in 2015, state exports declined by 2.8% last year.

As Exhibit 2 shows, Arizona merchandise exports to Mexico declined by -9.2% last year. This is key because Mexico is by far the state’s most important export destination. In 2016, Mexico accounted for 37.8% of Arizona merchandise exports. Canada was the next largest destination, accounting for 9.4% of state exports. Thus, state exports to NAFTA countries accounted for 47.2% of the total. Keep in mind that Arizona exports go all over the world, with 29.8% going to Asia, 17.7% to Europe, and 5.3% to all other countries combined. State exports to Canada, Europe, and the rest of the world also fell last year. Asia was the only export destination to post growth, driven largely by a surge in exports to South Korea.

One key reason why Arizona’s exports to Mexico fell last year was the major appreciation of the U.S. dollar versus the Mexican peso. Indeed, since June 2014, the dollar has risen by 57.8% against the peso. In contrast, the U.S. dollar is up 23.2% against the Canadian dollar. With the major rise of the dollar versus the peso, it makes sense that state exports would be adversely affected. However, state export performance was uneven across industries. Exports of computers and electronic components, as well as transportation equipment, increased. These are the state’s two largest export sectors. Playing an important role in the overall decline was a major drop in mineral and ore exports (down 30.9%). Exports of non-electrical machinery and chemicals also declined last year.

Recent political events have put further upward pressure on the U.S. dollar versus the Mexican peso. Indeed, since the election, the exchange rate has hovered between 20.0 and 22.0 pesos per dollar. The impact of recent statements by the new administration on NAFTA, immigration, and trade policy in general have increased uncertainty on both sides of the border. While the imposition of a unilateral tariff on Mexican goods crossing the border would hurt Arizona exports, this differs from proposals to impose a border adjustment. The border adjustment is part of a proposed overhaul of the U.S. tax system that would also affect U.S. export performance and the value of the U.S. dollar. Many economists expect the overall plan to have little impact on the trade deficit. The devil is in the details, however, and we will have to keep a close eye on how federal tax and trade policy evolve in coming months and years.

Arizona Outlook

The state outlook depends in part on future national economic performance. The national forecast calls for continued growth, which accelerates in the near term and then tapers off as time passes and demographic forces slow gains.

The forecast calls for real GDP growth to accelerate from 1.6% in 2016 to 2.3% in 2017 and again to 2.6% in 2018. Stronger growth in 2017 is related to easing of the inventory correction and stronger energy sector investment. A policy-related boost to growth is expected in 2017-2018, as tax cuts, increased government spending, and deregulation spur gains. Thereafter, real GDP growth decelerates to just below 2.0% per year by 2026. In contrast, job growth gradually decelerates as the aging of the baby boom generation drives down labor force gains.

One key force driving economic growth is productivity. U.S. productivity gains have been very sluggish since the end of the Great Recession. The forecast calls for productivity to accelerate in the near term, rising to rates similar to past history. Keep in mind that if this does not occur, then the U.S. economy will post slower real GDP growth and likely faster inflation.

On the international front, the U.S. dollar is expected to rise by an additional 5.3% in 2017, against a broad market basket of currencies, before stabilizing in 2018 and then gradually depreciating during the next three years.

Continued national growth sets the stage for Arizona gains during the forecast. The state is forecast to continue adding jobs, residents, and income at pace above the national average. However, growth is expected to remain well below averages rates during the 30 years before the Great Recession.

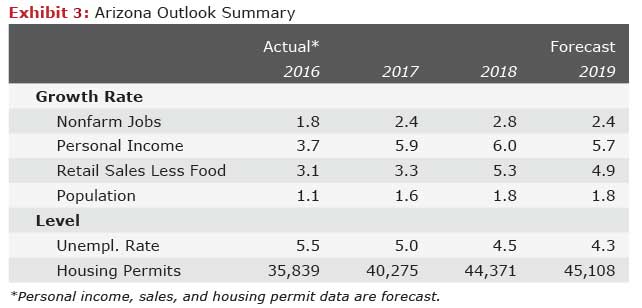

As Exhibit 3 shows, job growth is forecast to rise from 1.8% in 2016 to 2.4% this year, then to 2.8% in 2018. From 2018 through the end of the forecast period, job growth gradually decelerates, reflecting the impact of the current demographic shift (large numbers of baby boomers retiring).

Personal income follows the same basic trend as employment, although the strong acceleration in 2017 is driven in part by the large increase in the state-mandated minimum wage. The minimum wage rose from $8.05/hour in 2016 to $10.00/hour in 2017. It is scheduled to rise to $10.50/hour in 2018, then to $11.00/hour in 2019, and finally to $12.00/hour in 2020. Thereafter it rises with inflation. The broader impacts of the minimum wage increase on employment, profits, and prices are uncertain at this point. Past research (on much smaller changes to the minimum wage) suggest modest negative employment impacts and modest increases in price levels.

Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!