Fourth Quarter 2016 Forecast Update

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

![]() The Arizona economy slowed during the summer, with job growth falling back to the national rate. Further, new personal income estimates suggest slower growth early in the year. While Arizona continues to expand at a solid pace, 2016 no longer appears to be the breakout year. Nonetheless, the odds still favor continued growth in the U.S. and Arizona economies this year and next.

The Arizona economy slowed during the summer, with job growth falling back to the national rate. Further, new personal income estimates suggest slower growth early in the year. While Arizona continues to expand at a solid pace, 2016 no longer appears to be the breakout year. Nonetheless, the odds still favor continued growth in the U.S. and Arizona economies this year and next.

The outlook for Arizona calls for solid gains in jobs, income, and population. While growth rates are expected to far exceed the nation, they are not headed back to historical averages. Job gains will likely be concentrated in service-providing industries, like professional and business services; education and health services; trade, transportation, and utilities; and leisure and hospitality.

Arizona’s two largest metropolitan areas have also experienced a summer lull, but are expected to rebound later this year and in 2017. As usual, the Phoenix MSA is forecast to expand at a rapid pace. The Tucson MSA is expected to capitalize on recent announcements of new jobs in the aerospace sector to generate improved gains during the forecast.

Arizona Recent Developments

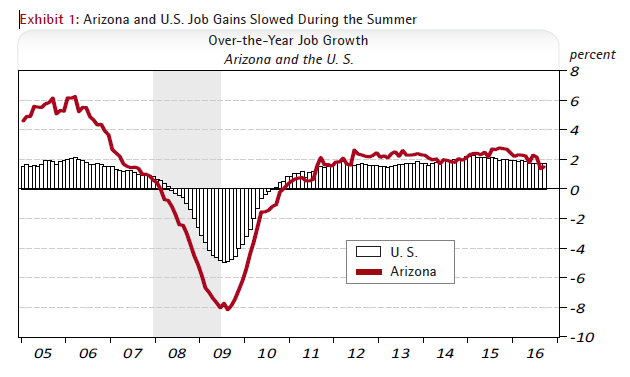

The Arizona economy continued to add jobs during the summer, although the pace slowed. Over the year, Arizona added 44,400 jobs for a 1.7% growth rate. That matched the national rate, but fell short of the pace set in the second quarter of 2.1%. Using monthly data, Exhibit 1 shows that state job growth dipped slightly below the national pace in September. Keep in mind that the employment data referenced here result from EBRC’s benchmark and differ from those currently published by the U.S. Bureau of Labor Statistics (BLS).

One key indicator to track these days is growth in wages per worker. The preliminary data for the first quarter of 2016 suggested that we may have seen the beginning of a stronger recovery in wages. A downward revision to wages and salaries in the first quarter now suggests that we may still be waiting. Over the year growth in wages per worker was below 2.0% for both the first and second quarters of this year. Keep in mind that annual growth in wages per worker was in the 4.5% per year range during the 2004-2007 period.

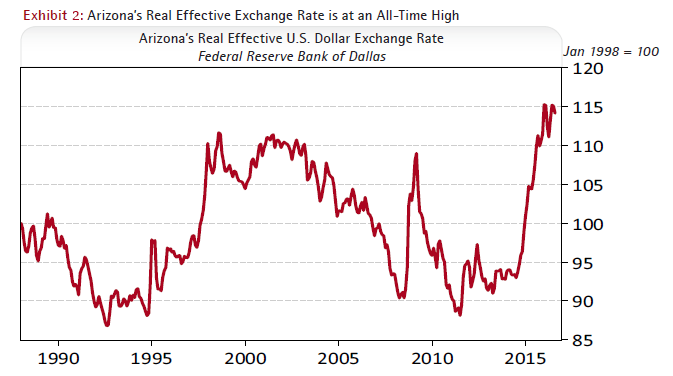

The U.S. dollar has risen substantially against most currencies since mid-2014. We can get a sense of what this might mean for Arizona’s exports using a real effective exchange rate for Arizona that is published by the Federal Reserve Bank of Dallas. This exchange rate weights changes in U.S. dollar bilateral exchange rates using state-specific merchandise export shares, adjusted for relative inflation rates. This is the exchange rate that really matters for Arizona’s exports to the world (Exhibit 2).

Note that Arizona’s real effective exchange rate is at an all-time high (at least since 1988). Further, it has risen 22.2% since mid-2014. A rising dollar tends to put downward pressure on exports (and upward pressure on imports), other things the same.

After weakening briefly during the spring, the U.S. dollar is again hitting new highs against the Mexican peso. On average during September, one U.S. dollar bought 19.24 pesos, which was 48.1% higher than in June 2014. The U.S. dollar is also up significantly against the Canadian dollar, having risen by 21.0% since mid-2014. Mexico and Canada are Arizona’s two largest merchandise export destinations.

The strength of the dollar is beginning to weigh on Arizona’s merchandise export performance. Through July 2016, Arizona’s exports to Mexico have fallen 13.2%, compared to the same period last year. The bulk of the decline originated in non-manufacturing goods, primarily minerals and ores. Exports of commodities tend to be especially volatile and mineral and ore exports are coming off very strong performance in 2014-2015. Manufacturing exports are also down so far this year, but by a modest amount.

The strong dollar may also be affecting Mexican visitors to the state. Legal northbound border crossings from Mexico through Arizona’s border ports of entry have slowed since mid-2014 for personal vehicles, personal vehicle passengers, and buses. Interestingly, pedestrian crossings have accelerated recently.

Arizona Outlook

The Arizona outlook depends in part on the national economy. IHS Economics projects that U.S. real GDP growth will hit just 1.4% in 2016, down from 2.6% last year. Gains accelerate next year to 2.2% and hold steady at that rate through 2019. Sluggish growth in 2016 reflects an inventory draw down, slower consumption spending, weak nonresidential fixed investment (especially in the energy sector), slower gains in residential investment (housing), and weak export performance. Slightly stronger gains are expected in 2017, as rising oil prices spur renewed investment in the energy sector and a gradually falling dollar spurs stronger export gains.

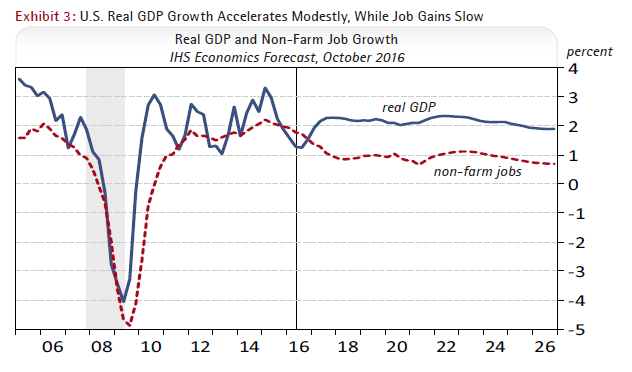

As Exhibit 3 shows, accelerating real GDP growth is expected to be accompanied by slower job growth. The ongoing retirement of the baby boom generation is expected to weigh on job gains during the forecast period. Note that during the past five years, real GDP and job gains have been unusually similar, which reflects the very slow productivity growth the U.S. has experienced since the end of the Great Recession. This is a shift from the typical pattern, in which real GDP gains outpace job growth by a substantial margin. As the exhibit shows, the forecast assumes that the normal pattern re-emerges. This is a crucial assumption.

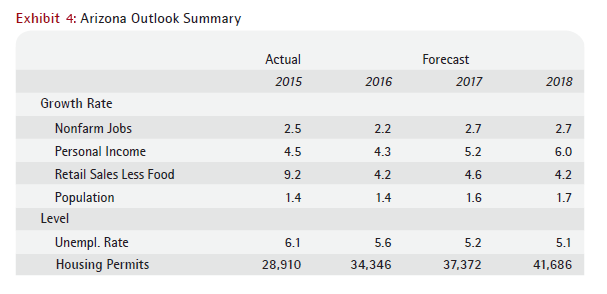

Continued global and national growth sets the stage for Arizona to continue to add jobs, residents, and inflation-adjusted income. As Exhibit 4 shows, the forecast calls for job growth to decelerate slightly this year, before picking up steam again in 2017 and 2018. After a brief acceleration in the near term, job growth in the state gradually softens as the retirement of the baby boom generation increasingly impacts economic growth. Nonetheless, Arizona’s job growth is expected to outpace the national rate during the next 10 years.

Arizona’s income growth accelerates as job growth gains momentum. Wages rise more rapidly in the near term, as the state unemployment rate continues to fall. This sets the stage for continue gains in household spending, including spending on taxable goods. Keep in mind that the strong increase in retail sales in 2015 was driven in part by a change in tax law that shifted some revenues from contracting into retail sales.

Population rises during the forecast, driven primarily by net migration, as U.S. residential mobility improves during the forecast. Faster population growth, in turn, boosts housing permits and construction employment.

Overall, Arizona’s growth is on track for solid performance: above the national rate in most cases, but slower than our historical averages.

Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!