Third Quarter 2016 Forecast Update

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

Arizona’s economy is well positioned to outpace the U.S. during the next 30 years. The outlook calls for the state, the Phoenix metropolitan statistical area (MSA), and the Tucson MSA to grow faster than the nation across most major macroeconomic aggregates. However, as is expected for the nation, the state is not likely to regain the rapid growth rates posted during the 30 years before the Great Recession. In the end, the aging of the baby boom generation will take a toll on growth at the national, state, and local levels.

Arizona’s recent growth continues to be strong, with job gains far outpacing the national average. This is true even for Tucson, where employment increases have accelerated strongly during the past nine months. The outlook calls for growth rates to improve in the near term, with reduced fiscal drag and increased migration flows into the state. This drives further gains in construction and related sectors, which have been slow to rebound from the housing bust. Overall, the state economy is moving forward and its trajectory is positive.

Arizona Recent Developments

Arizona added 64,400 net new jobs in the second quarter of 2016, compared to the same period of last year. That translated into 2.5% growth, which far outpaced the national average of 1.8%. The Phoenix metropolitan statistical area (MSA), which includes both Maricopa and Pinal counties, grew faster in the second quarter at 2.9% (54,300 new jobs over the year). The Tucson MSA also posted strong job gains over the year, with growth of 2.2% (8,200 new jobs). Keep in mind that these data reflect EBRC’s benchmark estimates and thus differ from data currently published by the U.S. Bureau of Labor Statistics (BLS). Note as well that construction jobs were up by 7.0% during the past four quarters, reflecting in part rebounding residential construction activity. Three sectors lost jobs over the year: mining and logging (reflecting low copper prices), government (losses concentrated in the state and local sector), and other services.

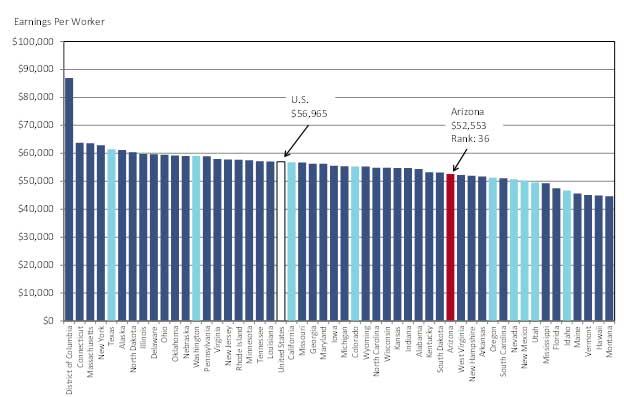

Even though Arizona is generating job growth in excess of the national average, our earnings remain below average. Exhibit 1 shows how Arizona stacks up against all U.S. states and the District of Columbia, after adjusting for the cost of living using relative price parities provided by the U.S. Bureau of Economic Analysis (BEA). BEA estimates that Arizona’s cost of living was 3.6% below the national average in 2014.

Adjusted for the state’s cost of living, per worker earnings in Arizona hit $52,553 in 2014 (we do have earnings data for 2015, but estimates of the cost of living extend only through 2014). The data show that Arizona’s adjusted earnings per worker were 7.7% below the national average, ranking the state 36th in the nation. Overall, Arizona ranked below average in per worker earnings. However, state earnings were above those in Oregon, Nevada, New Mexico, Utah, and Idaho, but below earnings in Colorado, California, Washington, and Texas.

Exhibit 1: Arizona’s Per Worker Earnings Were 7.7% Below the Nation in 2014

Adjusted for Cost of Living Using Regional Price Parities

Arizona Outlook in the Short Run

The short-run outlook calls for the U.S. economy to continue to expand during the next three years, although at a fairly modest pace. Real GDP growth is expected to average 1.9% this year, then to accelerate modestly to 2.4% in 2017 and 2018. Slow nonresidential investment and export activity restrain gains this year, as does slower growth in consumption. Sluggish export activity is in part connected to the fallout from Brexit. Residential investment is expected to remain robust during 2016 and 2017, in spite of increasing interest rates.

The subdued national outlook translates into something similar for Arizona. Job growth is forecast to rise from 2.5% in 2015 to 2.8% this year, then again to 3.0% in 2017.

Arizona Outlook in the Long Run

The long-run outlook for Arizona calls for continued growth in the major macroeconomic aggregates, like jobs, population, and income. While Arizona’s growth rates are expected to exceed the national average, the forecast does not call for a return to the pace of growth set during the 30 years before the Great Recession (1977-2007). It is much the same story for Phoenix and Tucson.

The forecast calls for Arizona to add 1.8 million jobs during the next 30 years, with total employment reaching 4.5 million by 2046. The average pace of job growth is forecast to be 1.7% per year, which is more than double the expected national rate of 0.7% per year. Arizona jobs are forecast to rise by 2.3% per year during the next decade, then by 1.6% per year during the 2026-2036 period, and finally to decelerate to 1.3% per year during the 2036-2046 period. The gradual deceleration is driven by the aging of the baby boom generation which mirrors the national trend.

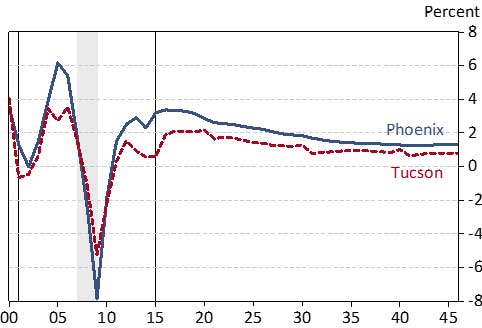

Both Phoenix and Tucson are forecast to generate faster job gains in the next few years, as Exhibit 2 shows. However, they do not escape the demographic slowing in the longer term. The Phoenix MSA is forecast to add 1.5 million jobs during the next 30 years, which implies an average annual growth rate of 1.9% per year. Further, this means that Phoenix accounts for 83.4% of statewide job gains during the period. The Tucson MSA also adds jobs during the 30 year period, with employment increasing by 162,000 or 1.2% per year. Tucson is expected to account for 9.1% of job gains during the forecast.

Exhibit 2: Job Gains Accelerate in Phoenix and Tucson in the Near Term,

Annual Job Growth Rates

Population growth is expected to continue for the state, Phoenix, and Tucson during the 30 year period, outpacing the nation but falling short of past results. Most of the population gains during the forecast are driven by net migration. Natural increase (the difference between births and deaths) continues to be positive during the forecast, but drifts down as demographic aging takes hold. Overall, the state is forecast to add 3.6 million residents during the 30 year period, with population rising from 6.9 million in 2016 to 10.5 million by 2046. That translates into an average annual rate of 1.4% per year, which is much faster than the national rate of 0.6% per year, but falls well short of the state’s growth rate of 3.2% per year during the 30 years before the Great Recession.

Risks to the Outlook

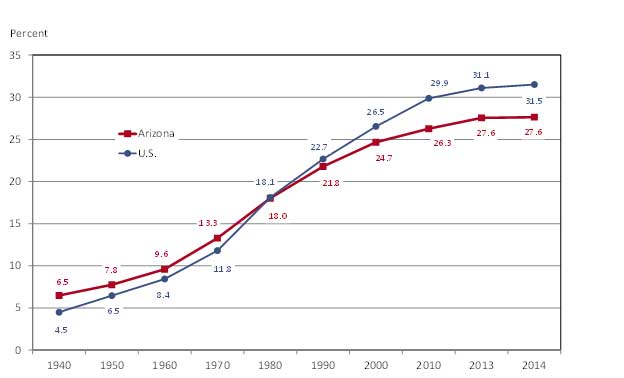

Longer-term risks revolve around the main determinants of state and local economic performance. One of these is human capital accumulation, which is often measured by educational attainment. During the past 74 years, the share of Arizona’s working age population with a bachelor’s degree or better has steadily increased, as Exhibit 3 shows. That is a good thing. However, during that time Arizona has also steadily lost ground relative to the nation. Indeed, in 2014, Arizona’s educational attainment rate was 3.9 percentage points below the national average. Without better performance in educational attainment, it is hard to see the state keeping up with national per capita income gains.

Exhibit 3: Arizona’s Working Age College Attainment Rate Falls Behind the U.S.

Share of the Population Age 25-64 with a Bachelor’s Degree or More

Infrastructure is another key component of state and local economic performance. This includes investment in highways, roads, water, sewer, telecommunications, airports, and border ports. Facilitating improved trade, travel, and communications flows across the country and around the world will be important for Arizona to remain economically competitive.

Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!