Second Quarter 2016 Forecast Update

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

Economic growth in Arizona accelerated last year, with faster job and population gains. Employment increased 2.6% for the state outpacing last year’s 2.0% rate. Population growth rose modestly from 1.3% to 1.4% last year, while personal income gains decelerated slightly from 4.7% to 4.6%, according to preliminary estimates. The Phoenix and Tucson metropolitan statistical areas (MSAs) posted better growth last year across most indicators, as well.

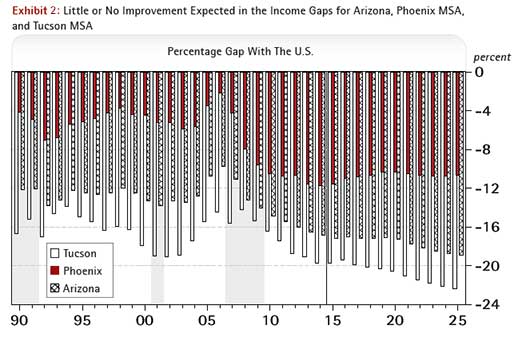

Early returns for 2016 suggest even stronger gains this year, with employment increasing faster than the national rate for the state, Phoenix MSA, and Tucson MSA. The forecast calls for this initial strength to be sustained through the year, generating solid gains in 2016, 2017, and 2018, assuming the national economy continues to expand. Overall, job, population, and income gains are expected to outpace the nation during the forecast. However, on a per capita basis, Arizona, Phoenix, and Tucson are expected to make little or no progress in closing the income gap with the nation.

Arizona Recent Developments

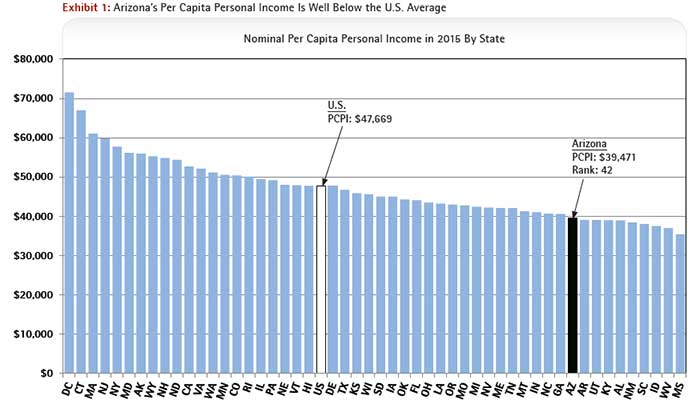

Arizona’s nominal per capita personal income hit $39,471 in 2015, according to the latest preliminary estimates from the U.S. Bureau of Economic Analysis (BEA). National per capita personal income was $47,669. Arizona’s per capita personal income rose 3.2% from 2014 to 2015, before adjustment for inflation, a bit below the national rate of 3.5%.

Arizona’s per capita personal income was calculated using the Arizona Department of Administration population estimate for 2015, so it differs a bit from the number published by the U.S. BEA. Also, keep in mind that the data is frequently revised. If you’re reading this months after it was completed, the current data may be a bit different.

Overall, state per capita income remains well below the national average and well below per capita income in most states. Indeed, Arizona’s income was 17.2% below the U.S. average last year. As Exhibit 1 shows, Arizona’s per capita income ranked 42nd out of 50 states and the District of Columbia. Arizona’s per capita personal income was also well below that of most western states, including California, Washington, Colorado, Texas, Oregon, and Nevada. Arizona’s per capita income was above that of Utah, New Mexico, and Idaho in 2015.

Arizona’s large per capita income gap was driven primarily by low earnings per employed resident, which accounted for 10.0 percentage points of the gap. The next largest contributions came from low dividends, interest, and rent per capita (3.6 percentage points), the employment-population ratio (3.6 percentage points), and transfer payments per capita (0.2 percentage points).

Overall, the income gap is large because wages are relatively low in Arizona. That, in turn, is likely driven by some combination of the state’s industry/education mix, the attractiveness of the state as a migration destination (both domestic and international), and slow gains in human capital accumulation compared to the U.S.

Early returns so far in 2016 suggest a surge in job growth for Arizona, the Phoenix MSA, and the Tucson MSA. From the first quarter of 2015 to the first quarter of 2016, Arizona added 81,300 jobs. That translated into a rate of 3.1%, which was well above average gains last year. Many of the job gains over the year were in education and health services; professional and business services; trade, transportation, and utilities; and financial activities. These four sectors accounted for 76.8% of employment gains. Construction jobs increased, as did manufacturing jobs. Employment in government and natural resources and mining declined.

Arizona Outlook

The outlook for Arizona, the Phoenix MSA, and the Tucson MSA depends in part on the performance of the U.S. economy. Overall, the nation is expected to continue to grow, with increasing real GDP, jobs, income, and population. The baseline (most-likely) projections call for real GDP to rise by 2.1% in 2016, slightly slower than the 2.4% rate posted last year. Much of the slowdown arises from the weak first quarter results (up 0.5% according to the advance estimate). Real GDP is expected to accelerate to 2.8% in 2017 and 2.7% in 2018, before gradually setting back to the 2.4% per year range. The near term acceleration is driven by the gradual drawdown of inventories, less drag from oil producing states, less fiscal drag, and better export performance.

U.S. growth sets the stage for continued gains for Arizona, the Phoenix MSA, and the Tucson MSA. The state is forecast to add 78,600 jobs in 2016 (3.0% growth) and to sustain that pace through 2018. Leading sectors during the next three years are expected to be professional and business services; education and health services; trade, transportation, and utilities; and construction. The gains in construction activity reflect (in part) stronger housing construction activity, with total housing permits rising from 31,850 in 2015 to 46,830 in 2018.

The forecast is similar for the Phoenix MSA, with job growth rising from 3.3% in 2015 to 3.5% in 2016 and 2017, before softening slightly in 2018

The Tucson MSA also accelerates in the near term, with job growth rising from 0.8% last year to 1.7% in 2016 and to 2.0% by 2018. Population gains recover, after a weak year in 2015, to hit 1.2% by 2018. Overall, Tucson benefits from reduced federal fiscal drag.

Per capita income is forecast to rise during the forecast for Arizona, the Phoenix MSA, and the Tucson MSA. That is true even if we adjust for the impact of inflation. However, per capita income for Arizona and its two largest metropolitan areas is not expected to close the gap with the U.S. and may well fall further behind. Thus, as Exhibit 2 shows, the per capita income gap with the nation is expected to rise during the next 10 years. For Arizona, the gap is forecast to rise from 17.2% in 2015 to 18.9% by 2025. The gap for the Tucson MSA is forecast to rise from 19.7% in 2015 to 22.3% by 2025. The gap for the Phoenix MSA is forecast to fall modestly, from 11.6% in 2015 to 10.6% by 2025.

Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!