George W. Hammond, Ph.D.

Director and Research Professor, EBRC

Sluggish gains in Arizona employment, income, and retail sales continued in the fourth quarter of 2014. Overall, the state is growing at rates that are in the neighborhood of the nation, but that are well below our own past history.

What is holding the state back? First, population growth is positive but slow and this is contributing to an unusually weak housing/construction recovery. Second, federal fiscal drag continues to weigh on the state economy. The outlook calls for the state to gradually gain momentum in coming years, with help from lower gasoline prices, faster national growth, and a bit less federal fiscal drag.

Arizona Recent Developments

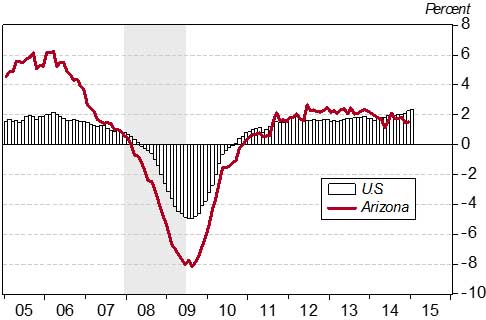

Arizona added jobs during the final three months of 2014, but at a moderate pace. As Exhibit 1 shows, the state’s over-the-year job gains were close to, or even below, the national average for much of 2014. Keep in mind that the exhibit reflects Arizona job growth measured by EBRC’s benchmark, which incorporates data from the Quarterly Census of Employment and Wages through June 2014.

Exhibit 1: Arizona’s Job Growth Still Sluggish at the end of 2014

(over-the-year job growth by month)

Overall, the state added 41,800 jobs in the fourth quarter of 2014, compared to the last quarter of 2013. That translated into a job growth rate of 1.6% over the year, which was below the national growth rate of 2.1%.

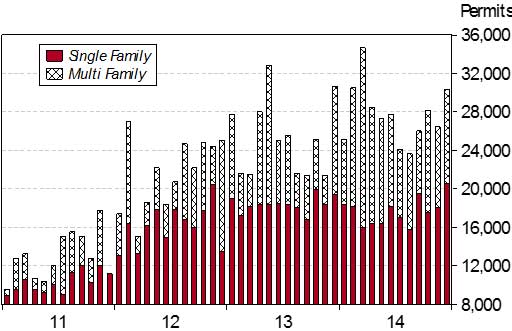

Construction activity remains a key concern for state growth. Recently the state has lost construction jobs, which reflects weakness in the construction of buildings. Part of this is related to residential activity. As Exhibit 2 shows, state housing permits rose rapidly in 2012 and into early 2013, but thereafter growth slowed. Further, gains in 2014 were driven entirely by multi-family activity, because single-family permits declined.

The preliminary data suggest that Arizona housing permits rose by 9.9% in 2014, or roughly 2,500. Multi-family permits were up by 47.3% for the year, while single-family permits declined by 3.9%. The strength in multi-family permits reflects rising single-family house prices, still tight mortgage lending conditions, and demographic factors.

Housing activity has been sluggish in part because of weak population and household growth. According to the Arizona Department of Administration, the state added 86,200 residents between July 2013 and July 2014. That translated into a rate of growth of 1.3%, which exceeded U.S. growth of 0.7%. Population in the Phoenix MSA rose by 1.5% in 2014 and 1.1% in the Tucson MSA. Both natural increase (births minus deaths) and net migration contributed to growth during the past year.

Continued job and population growth have contributed to personal income gains in Arizona. While Arizona personal income rose at a faster rate than the nation last year, growth was not very rapid by historical standards. For instance, real personal income growth in the state during the past four quarters was 2.2% (U.S. consumer price inflation was 1.8%). That was far below the state’s average rate during the 30 years before the Great Recession, of 4.8% per year.

Unspectacular income gains lately have resulted in similarly uninspiring gains in retail sales. Taxable retail sales less food was up 4.7% year to date through November. The annual growth rate for 2014 is likely to lower because of a large one-time transfer into the category in December 2013. Taxable sales at restaurants and bars were up 8.2% year to date through November.

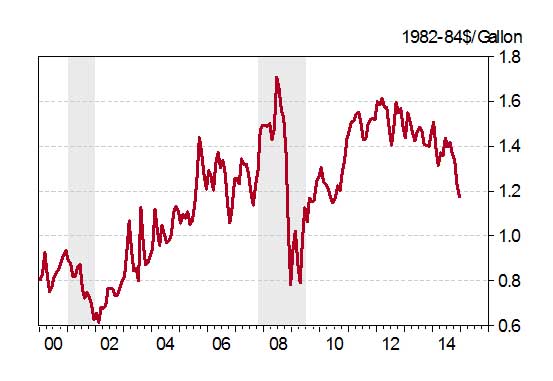

One hopeful sign for retail sales growth in 2015 is the massive decline in gasoline prices since last summer. Indeed, Phoenix gas prices dropped from $3.41/gallon in June 2014 to $2.16/gallon in January 2015. That translated into a 36.7% drop. On an inflation-adjusted basis, Phoenix gas prices have been gradually trending down since 2012 and are now at levels last seen in 2010, as shown in Exhibit 3. U.S. gas prices followed a similar trend. Since gasoline purchases make up a significant share of household budgets, this may free up resources for households to spend on other priorities.

Exhibit 3: Real Gasoline Prices Have Been Trending Down

(Phoenix inflation-adjusted gasoline prices)

Arizona Outlook

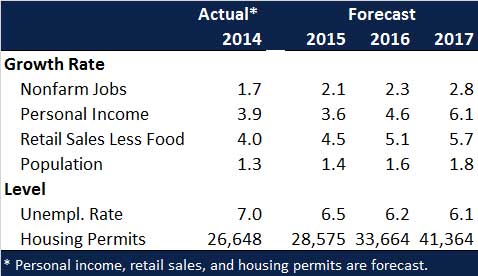

The Arizona outlook calls for the state to add jobs, residents, and income at a gradually accelerating pace, as Exhibit 4 illustrates. Stronger gains reflect rising residential mobility across the U.S., reduced federal fiscal drag, and the positive impact of lower gasoline prices.

The forecast calls for job growth to accelerate from 1.7% in 2014 to 2.1% in 2015 and eventually to 2.8% by 2017. Most of the job gains during the period are expected in service-providing sectors, particularly trade, transportation, and utilities; professional and business services; education and health services; and leisure and hospitality. These four sectors alone account for 68.3% of net job growth during the next three years.

Arizona’s population gains are expected to accelerate in the near future. In turn, rising population gains push construction activity higher during the forecast. Total housing permits are forecast to rise from 26,600 in 2014 to 41,400 by 2017, with increased single and multi-family activity. In turn, rising construction activity drives construction jobs up by nearly 16,000 between 2014 and 2017.

Accelerating job gains boost income levels during the forecast. Arizona personal income is forecast to rise by 3.6% in 2015, 4.6% in 2016, and 6.1% in 2017. Rising wage gains contribute to the acceleration, as do growth in asset and transfer income. Personal income gains are expected to exceed both population growth and inflation, which implies a gradually rising standard of living.

The outlook for the Phoenix and Tucson MSAs calls for growth to rebound modestly during the next three years. The Phoenix MSA is expected to outpace the Tucson MSA, which will continue to battle the effects of reduced federal spending.

Browse the latest EBRC economic forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Photo of Arizona desert bloom courtesy of Shutterstock.