By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

September 1, 2014

Arizona’s economic growth slowed during the spring of 2014, with job growth falling back to the U.S. average. Nonetheless, the state economy continues to expand and growth is likely to continue as long as the nation avoids recession. Indeed, the forecast calls for Arizona’s growth to pick up speed during the 2015-2017 period, with gains across most indicators far exceeding national results.

The near-term acceleration is eventually replaced by long-term deceleration, as the aging of the baby boom generation weighs down gains. Again, it is important to keep in mind that Arizona is likely to continue to outpace the nation. The long-term projections call for the state’s population to rise by 3.9 million during the next 30 years, accompanied by an additional 1.8 million jobs.

Arizona Recent Developments

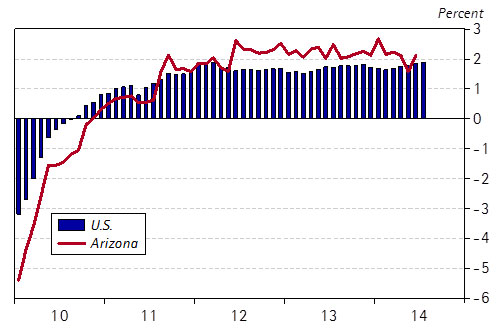

Arizona’s year-over-year job growth softened in the spring of 2014, falling from 2.4% in the first quarter to 1.9% in the second. Statewide job growth in the second quarter fell back to the national rate, something we have not seen since early 2012 (Exhibit 1).

The slowdown in the second quarter was driven by slower over-the-year job gains across most of the service-providing sectors combined with a sharp drop in government jobs and a modest decline in construction employment. The decline in government jobs reflected a large drop in the state and local sector (particularly in education), as well as fewer federal employees.

The recent weakness in construction job growth is a continuation of a trend that emerged during the second half of 2013 and reflects slowing growth in residential construction activity. Housing permits in Arizona increased by 57.5% between the second half of 2011 and the second half of 2012. However, by the second half of 2013 that growth rate had dropped to -2.5%. This was driven by a decline in multi-family permits, although single-family permit growth slowed as well.

There is some hopeful news in the housing permit data in the first half of 2014, with a rebound in the volatile multi-family sector. This primarily reflects increased activity in the Phoenix MSA. In contrast, single family permits have continued to weaken statewide. Overall, the recovery in housing permit activity during the first half of 2014 suggests that related construction employment should recover modestly as building activity begins on permitted projects.

Arizona Outlook in the Long Run

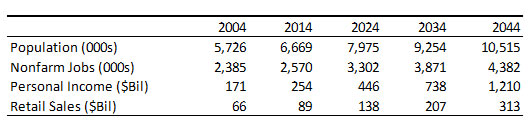

The long-run forecast, which extends to 2044, calls for the state to add jobs and residents at a faster pace than the nation. As Exhibit 2 shows, Arizona’s population is forecast to rise by 3.9 million during the next 30 years, to 10.5 million residents. That translates into an increase of 57.7% during the 30-year period. Similarly, state jobs rise by 1.8 million, reaching 4.4 million in 2044. Personal income also increases during the next 30 years, reflecting both the impact of inflation and a rising standard of living. By 2044, nominal personal income is expected to exceed $1.2 trillion dollars. Rising income translates into rising retail sales, which reach $313 billion by the end of the forecast period.

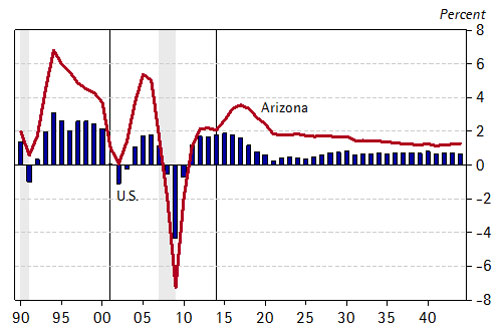

Exhibit 3

shows the outlook for job growth in Arizona, compared to the nation. As the exhibit shows, Arizona’s job growth accelerates in the near term. However, after peaking in 2017, job growth gradually decelerates during the remaining years of the forecast. This reflects the aging of the baby-boom generation, which will reduce growth across a range of indicators in coming years. Indeed, the forecast calls for job growth to average 1.8% per year from 2014-2044, which is less than half the state’s average growth rate during the 30 years before the Great Recession (4.1% per year). Nonetheless, Arizona’s job growth is expected to outpace the national average by a substantial margin.

Steady job gains will contribute to personal income growth by generating gains in wages and fringe benefits. The state’s income growth will also receive a boost from increased asset income (dividends, interest, and rent) as well as transfer payments. The forecast calls for transfer payments, which include Social Security, Medicare, Medicaid, and other welfare transfers, to account for 30.9% of personal income by 2044, up from 20.4% in 20.3% in 2014.

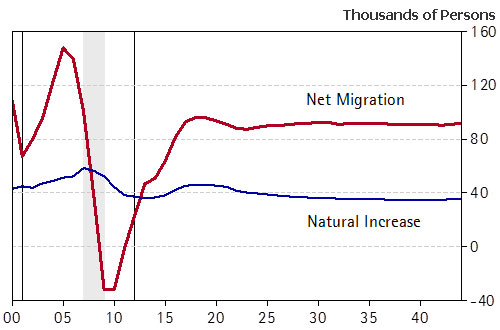

The forecast calls for Arizona’s population to rise at an average rate of 1.5% per year during the next 30 years. Growth is stronger in the near term, as accelerating net migration and a modest improvement in natural increase (births minus deaths) both contribute to growth (Exhibit 4). However, after 2018 net migration plateaus and natural increase loses steam, pulling Arizona’s population growth down with it. Declining natural increase reflects the coming demographic aging, which drags down births and boosts deaths. Even with slowing growth during the long-run, Arizona will continue to outpace national population growth.

Exhibit 4: Improved Net Migration Boosts Arizona’s Population Growth

Net Migration and Natural Increase

Arizona’s population growth accelerates in the near term. This reflects faster national growth and rising house prices, which boosts residential mobility across the U.S., and net migration into the state. Rising population growth drives up residential construction activity, with housing permits increasing to 55,000 by 2018, from the 28.000 range in 2014.

Photo of winding road runs through it in the Valley of Fire State Park courtesy of Shutterstock.