By George W. Hammond, Ph.D.

EBRC Director and Eller Research Professor

June 1, 2014

According to the latest preliminary data, the Arizona economy is still expanding at a slow pace. With employment rising by 2.1% in 2013, Arizona beat the U.S. average, but fell well short of our average growth rate during the 30 years before the Great Recession (4.1% per year). Likewise population expanded last year, but at a lackluster pace. Income growth suffered in 2013, as federal fiscal drag hit hard.

With federal fiscal drag expected to dissipate in the near term, the door is open for faster state growth. How fast that growth turns out to be will depend in part on the strength of the housing recovery. The forecast calls for construction activity to accelerate, driven by faster population gains. That will drive state growth up, but we will not see a return to the pace of growth experienced during the 30 years before the Great Recession.

Arizona Recent Developments

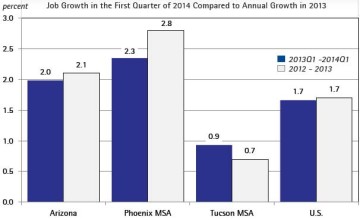

Arizona jobs continued to expand at a sluggish pace in the first quarter, with year-over-year growth coming in at 2.0%. As Exhibit 1 shows, that was faster than the 1.7% rate posted by the nation. As the exhibit also shows, job growth during the past year in the Phoenix MSA outpaced state and national rates, as well as the Tucson MSA.

State job growth in the first quarter of 2014 was not particularly strong, with year-over-year gains coming at about the same rate observed for 2013. First quarter growth in the Phoenix MSA was below the average for 2013, while job gains accelerated slightly in the Tucson MSA. Overall, Arizona started 2014 with relatively modest job increases, but still managed to outpace the nation.

During the past four quarters, Arizona added 49,500 jobs, with most of that increase concentrated in education and health services; trade, transportation and utilities; and financial activities. These three sectors together accounted for 71.1% of job gains during the past year. The state also posted job growth in leisure and hospitality; professional and business services; construction; information; and natural resources and mining. In contrast, the state lost jobs in government (federal as well as state and local); manufacturing (computer and electronic products and aerospace); and other services.

Residential Construction: Signs of Life?

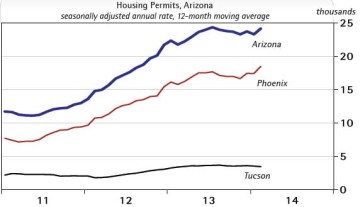

Construction jobs and housing permit activity decelerated during the second half of 2013. Construction jobs continued to rise at a slow pace in the first quarter of this year, while housing permit activity showed some early signs of life, particularly in the Phoenix MSA, as Exhibit 2 shows.

House price appreciation continued to decelerate in early 2014, with the Phoenix MSA Case-Shiller index up 12.5% over the year in February. That’s well down from February 2013, when the index rose by 23.0%. Slowing house price appreciation is related to reduced demand, both from investors and owner-occupiers, Exhibit 2.

Arizona’s Income Growth Struggles Along

According to the latest estimates from the U.S. Bureau of Economic Analysis, Arizona’s personal income rose by 2.7% in 2013, down from 3.6% in 2012. The deceleration was driven in large part by federal fiscal drag, with the expiration of the federal payroll tax holiday in January as well as the shifting of income from 2013 to 2012 in anticipation of tax changes related to the fiscal cliff.

Income gains in 2013 were slow, even before adjusting for population and inflation. Once we adjust for population growth, per capita personal income rose by just 1.4%. The national rate of inflation in 2013 was 1.4%, which means that the state experienced no increase in real per capita personal income last year. In contrast, U.S. real per capita personal income rose by 0.5%.

Growth in Arizona’s retail sales less food accelerated to 8.6% in 2013, up from 4.6% in 2012. Part of the acceleration in 2013 was driven by a reallocation of sales from the use tax category into retail sales. Nonetheless, faster retail sales growth in 2013 was somewhat surprising, given the deceleration in income growth. Part of the explanation may be increased wealth, with rising house prices and strong stock market performance during the year. Restaurant and bar sales decelerated from 6.8% in 2012 to 3.7% in 2013.

Arizona Outlook: A Little Better This Year

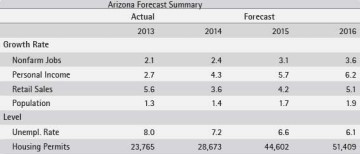

The forecast calls for a modest acceleration in Arizona’s job growth this year, with the rate rising from 2.1% in 2013 to 2.4% in 2014. As Exhibit 3 shows, the state’s job growth continues improve in 2015 and 2016. Keep in mind that even at 3.6%, job growth remains well below the average rate posted during the 30 years before the Great Recession (4.1% per year from 1977-2007). Thus, even though employment growth is expected to accelerate, the pace of activity will likely feel a bit slow.

Arizona’s job growth rises in the near term in part due to less federal fiscal drag. We do not expect a repeat of the 2013 payroll tax increase, the sequester, or the government shutdown. In addition, state growth benefits from the continued recovery of the housing sector.

Employment gains during the 2013-2016 period will be concentrated in the service-providing sectors, with trade, transportation, and utilities; professional and business services; and education and health services adding the most jobs. Within the goods-producing sector, construction jobs increase the most, which reflects the continued housing recovery.

Housing permits are expected to rise from 23,765 in 2013 to 51,409 by 2016. Gains are expected in both single-family and multi-family permits. The housing recovery is driven by improved population growth, which rises from 1.3% in 2013 to 1.9% by 2016. In turn, faster population gains reflect rising residential mobility across the U.S., driven by an accelerating national economy. Increased residential mobility translates into more net migration, which fuels faster state population gains.

Arizona’s real per capita income rises in 2014 after a rough 2013. The forecast calls for growth to accelerate to 1.2% in 2014 and again in 2015 to 2.4%. That reflects in part the reduced federal fiscal drag in 2014 as well as stronger job growth.

Aggregate retail sales (the sum of retail sales less food, restaurant and bar sales, food sales, and gas sales) decelerates in 2014, reflecting in part the large one-time reallocation of sales from the use tax into retail sales less food in 2013. Retail sales pick up in 2015, reflecting faster income growth.

Phoenix and Tucson are also expected to gain momentum in the near term. Job growth in Phoenix is forecast to accelerate from 2.8% in 2013 to 3.2% in 2014 and to 3.5% in 2015. Similarly, employment growth is forecast to accelerate in Tucson, rising from 0.7% in 2013 to 1.1% in 2014 and again to 2.0% in 2015. After peaking in 2017, growth gradually decelerates for both metropolitan areas during the remaining forecast period. This reflects the impact of the aging of the baby boom generation, with lower labor force growth driving slower overall economic gains.

Risks to the Outlook

The baseline forecast calls for the state to gradually gain momentum in the near term, followed by a demographically driven deceleration. While the baseline forecast is considered the most likely outcome, there are other scenarios to consider. The pessimistic scenario calls for federal fiscal drag to increase, instead of dissipating as assumed under the baseline forecast. That is combined with a less robust housing recovery and slower world growth (slow growth in China and disruptions caused by the conflict between the Ukraine and Russia), which generates much slower state growth in 2014-2015. The optimistic scenarios flips the script on the drivers of the pessimistic forecast, and the state accelerates much more rapidly than under baseline assumptions.

Photo of businessman pushing away scene of sail boat being circled by sharks courtesy of Shutterstock.