By George W. Hammond, Ph.D. EBR Associate Director and Eller Research Professor December 1, 2013

Arizona is still working its way out of the hole created by the Great Recession, but we are making progress. The state is generating growth in jobs, income, retail sales, and population. But we are not out of the hole just yet. For instance, while state jobs are growing at a faster pace than nationally, we have replaced just 49% of the jobs lost during the downturn. The forecast calls for Arizona to continue growing, and to outpace national growth for most indicators. In particular, the forecast implies that the state will replace all of the jobs lost during the Great Recession by 2015. If that turns out to be the case, it will have taken eight years for the state to get back on even terms. That is a testament to the severity of the downturn and the painful recovery.

Recent Developments

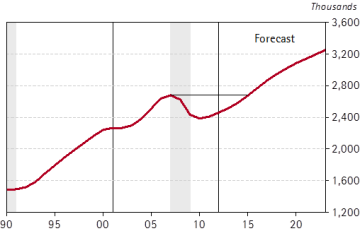

Exhibit 1: Inventory Accumulation Made a Big Contribution in the Third Quarter: Percentage Point Contributions to U.S. GDP Growth, 3rd Quarter 2013

U.S. real GDP rose by 2.8% in the third quarter of 2013, according to the advance estimate from the U.S. Bureau of Economic Analysis. That was faster than the 2.5% growth rate in the second quarter and the 1.1% growth rate in the first quarter. However, third quarter growth was still below the average growth rate during the 1929-2012 period of 3.3% per year. Overall, we have seen steady improvement in real GDP growth through 2013. Of the 2.8% increase in real GDP in the third quarter, 1.04 percentage points came from consumption spending with most of that spending originating in the goods sector (both durables and nondurables) (Exhibit 1). Growth in consumer services was modest in the third quarter. Investment spending contributed 1.45 percentage points to the third quarter growth rate, with particular strength in inventory accumulation. Removing inventory accumulation, real final sales of domestic product rose by 2.0% in the third quarter, slightly below the second quarter increase of 2.1%. Residential investment continued its upward trajectory in the third quarter and nonresidential investment contributed as well, although to a lesser extent. Net exports contributed 0.31 percentage points to growth, with gains in exports helped along by a drop in imports during the quarter. Finally, government spending was flat in the third quarter, with the (fourth consecutive) decline in federal spending roughly offset by an increase in state and local government expenditures.

Arizona Job Growth Beats Nation

Arizona’s year-over-year job growth continued to outpace the nation through August 2013, which is the most recent data available due to the federal shutdown. According to the latest EBR benchmark of employment estimates (to the March 2013 ES202 data) Arizona’s year-over-year job growth has been at or above 2.0% each month this year. In contrast, national job growth has been between 1.5% and 1.7% on a year-over-year basis. The state seasonally adjusted unemployment rate hit 8.3% in August 2013, up slightly from 8.0% in June and July. Arizona’s unemployment rate was slightly above the national average of 7.3% in August.

Housing Activity on the Mend

National housing activity slowed during the summer and Arizona followed suit. Total seasonally adjusted housing permits for the nation increased by 14.1% during the June-August period of 2013, compared to the summer of 2012. That was roughly one-half the percentage increase in 2012. In Arizona, total seasonally-adjusted housing permits during the June-August period of 2013 were up 7.2% on a year-over-year basis. That was far slower than the year-over-year increase in 2012 of 47.4%. The slowdown in Arizona was concentrated in single-family permits, although multi-family permit growth slowed during the summer as well. This slowdown may be related in part to labor shortages in construction and to high land prices in desirable areas. Housing permit activity in Phoenix and Tucson also decelerated during the summer of 2013, with the slowdown particularly evident for Phoenix. Both building activity and house prices have increased at rapid rates recently. However, both remain well below peak levels. Indeed, state total housing permits in 2012 totaled 21,726, according to the Census Bureau. That was a 67.0% increase over 2011 and a 75.6% increase over 2010. Even so, housing permits are at a very low level. Indeed, the last time Arizona housing permits were in the 22,000 range was the mid-1970s. Likewise, Phoenix house prices, measured by the Case-Shiller index, are up 41.2% from their bottom in September 2011. Even so, they are still 37.8% below the peak hit in June 2006.

Outlook: The Nation Has Room to Grow

The national economy is expected to limp out of 2013, with weak real GDP growth in the fourth quarter of 1.6% at a seasonally adjusted annual rate. Slower growth in the fourth quarter is driven by the impact of the federal government shutdown and uncertainty about fiscal policy in general. Growth accelerates in 2014 and 2015 as the federal fiscal drag diminishes, nonresidential fixed investment (business equipment and structures) rebounds, the housing recovery continues, and world growth picks up momentum. Federal fiscal drag is expected to dissipate in 2014, although a portion of federal spending is expected to be sequestered again during FY2014 and emergency unemployment insurance benefits are assumed to be phased out beginning in 2014. Thus, federal spending is expected to be less of a drag, but will not contribute to growth. The housing market is expected to continue its rebound, with national housing starts rising from 914,000 in 2013 to 1.6 million by 2016. Even so, that leaves starts 22.3% below their 2005 peak. The recovery in housing activity is driven by improvement in household growth, low interest rates, and gradually improving credit conditions. House prices continue to rise as well, although the rate of appreciation slows during the forecast. Finally, the outlook for the world economy calls for gradually improving growth through 2015, as the Eurozone picks up steam and other important trading partners (like China, Brazil, Russia, and India) follow suit. This generates improved export performance through 2015, with is roughly matched by growth in U.S. imports, driven by faster domestic income growth.

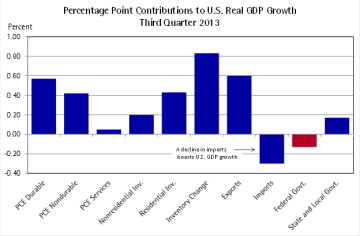

Arizona Bounce on the Horizon

The outlook for Arizona is positive. The state is well positioned to grow and for growth to accelerate. This forecast hinges on reduced fiscal drag in 2014-2015, continuing improvement in the housing market that is tied to increased residential mobility, and stronger U.S. and world growth. As Exhibit 2 shows, Arizona is forecast to regain its previous employment peak in 2015. Since that previous high was achieved in 2007, the forecast implies that it will take eight years for the state to get back to even terms after the Great Recession. The national economy is currently forecast to replace all of the jobs lost during the Great Recession by 2014, one year earlier than Arizona. The national economy reaches its previous high before Arizona primarily because the national downturn was less severe. Indeed, from peak to trough during the Great Recession, Arizona jobs declined by 11.8%, compared to 6.3% for the nation. Thus, it takes Arizona longer to dig out of the Great Recession because the state fell into a deeper hole.

Personal income growth bounces back in 2014 after a weak 2013, reflecting less fiscal drag and stronger job growth. State personal income growth is forecast to rise from 3.2% in 2013, to 5.2%, and to 5.9% by 2015. That acceleration reflects stronger growth in earnings by place of work; dividends, interest, and rent, as well as transfer payments. Retail sales growth follows the same pattern, but with a lag, so growth in 2014 slows but then accelerates in 2015 as faster income gains translate into additional consumption. Overall, retail sales growth is expected to be less than income growth during the forecast, which implies continued erosion of the sales tax base relative to income.

Population growth also accelerates during the forecast, as residential mobility is assumed to rebound. This boosts net migration to the state and drives population growth up to 1.9% per year during the 2016-2017 period. That is much faster than the 1.2% growth rate forecast for 2013, but it is far below the average growth rate during the 1976-2012 period of 2.9% per year. As population growth builds momentum in the near term, so does housing activity. Housing permits are forecast to rise from 24,362 in 2013 to 46,312 by 2015, and to 52,839 by 2016. This reflects growth in both single and multi-family permits.

Image of businessman and businesswoman pulling rope atop of mountain courtesy of Shutterstock.