By Dr. George Hammond

EBR Associate Director and Eller Research Professor

June 1, 2013

The Arizona economy continues to grow and improve in early 2013, but the pace overall is slow compared to historical standards. The outlook calls for the state to gather speed during the next two years, but only after another year of sluggish gains.

The same is true for the U.S. economy and for similar reasons. The federal sequester will begin to bite harder in the second quarter of the year and that, combined with the expiration of the temporary payroll tax cut, will be enough to keep real GDP growth in the 2.0% range this year.

Growth accelerates during 2014 and 2015, both for the state and the nation, as the impact of the federal fiscal drag fades and as the housing recovery really finds its feet.

U.S. Real GDP Growth: Don’t Drink the Kool-Aid

Real GDP growth accelerated significantly in the first quarter of 2013, after little growth in the last quarter of 2012, according to advance estimates. At 2.5%, real GDP growth in the first quarter far outpaced the 0.4% growth rate in the fourth quarter of 2012. However, even with that acceleration, the growth rate was still below the long-run average of about 3.0%.

It is important not to get too wrapped up in one quarter of data at this point, because the gains in the first quarter seem likely to peter out a bit. For instance, real consumption spending surged in the first quarter, but that was powered by a rapid decline in personal saving, not by income growth. Further, inventory investment also rose rapidly in the first quarter, an increase that does not seem made to last either. Government spending (especially defense) continues to drag down growth, and net exports contributed to slower gains as well. Overall, we are looking at an uneven start to 2013.

The nation’s job growth continues to grind along, with nonfarm payroll jobs rising by 165,000 (1.5% annual rate) in April on a seasonally adjusted basis. The slow and steady job growth is contributing to improvement in the unemployment rate, but it is slow going. Indeed, the seasonally adjusted U.S. unemployment rate hit 7.5% in April, which is well below the peak of 10.0% in October 2009, but it remains well above acceptable levels.

U.S. Growth Gathers Steam, After a Mediocre 2013

The U.S. outlook calls for uneven real GDP growth in the first half of 2013 to give way to stronger gains in the second half of the year. Overall, real GDP growth in 2013 is forecast to hit just 2.0% in 2013, then accelerate to 2.8% and 3.2% in 2014 and 2015. In other words, growth does not get close to trend rates until 2014-2015.

Part of the reason for modest growth in 2013 is the fiscal drag created by the expiration of the temporary payroll tax cut in January and the spending cuts associated with the sequester, which began in March. The increase in the payroll tax is expected to reduce 2013 real GDP growth by 0.4% and the sequester cuts are expected to cut another 0.4% off growth during the calendar year. The combined effects are sufficient to push growth well below trend.

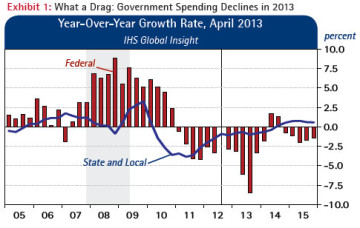

Our forecast calls for federal, state, and local spending to decline in 2013. Real federal non-defense spending is forecast to fall by 4.3% in 2013, while real defense spending falls by 5.8%.

The sequester impact is based on the assumption that the cuts will only last through September 30 of this year. Then they are expected to be replaced by a combination of tax increases and spending cuts (focused on entitlements) that are phased in beginning in 2014. As Exhibit 1 shows, the forecast calls for federal, state, and local spending to decline in 2013. Real federal nondefense spending is forecast to fall by 4.3% in 2013, while real defense spending falls by 5.8%.

The U.S. economy continues to grow in 2013, even with the fiscal drag restraining growth. Real consumer spending growth remains positive, if less than spectacular. Consumers continue to deal with headwinds (high debt levels, low house prices, and slow job growth), but we are seeing some improvement in debt loads and house prices.

In addition, the housing market continues to recover, with declining foreclosures, rising house prices and housing starts, and increased household formation. Overall, residential investment is now contributing to growth, instead of holding it back.

While fiscal policy is hitting the brakes, monetary policy remains aggressively expansionary. The forecast assumes that the Federal Reserve will keep the target federal funds rate at current levels through 2015, as the unemployment rate remains above 6.5%, inflation remains tame, and inflation expectations remain well anchored.

Finally, as the world economy slows, export growth will decelerate in 2013, and as global growth recovers in 2014-15, so will U.S. export performance.

Arizona Employment Expands

Arizona job growth continued in the first quarter of 2013, with seasonally adjusted state payrolls rising by 1.7% over the fourth quarter of 2012. On a year-over-year basis, the state added 46,100 jobs (1.9%) in the first quarter. That was faster than U.S. growth, which hit 1.5% in the first quarter on a year-over-year basis.

Job gains during the past four quarters have been strongest in leisure and hospitality (particularly eating and drinking places), construction, financial activities (especially finance and insurance), health care, wholesale trade, professional and business services, and state and local government (education).

Arizona job growth has outpaced the U.S. since hitting bottom in the fall of 2010, but even so, the state still has a long way to go to replace the jobs lost during the downturn. As of April 2013, Arizona has replaced 39.2% of the jobs lost during the Great Recession, compared to 70.4% for the U.S. The Phoenix MSA has replaced 43.6% of the jobs lost, while the Tucson MSA has replaced 36.1%.

The state unemployment rate continued to gradually improve in the first quarter, hitting 7.9% on a seasonally adjusted basis. That is well down from 8.5% during the first quarter of 2012 and is similar to the national rate of 7.7%. The Phoenix MSA unemployment has fallen by 0.8 percentage points during the past year, while the Tucson MSA rate has declined by 0.6 percentage points. Both metropolitan areas posted unemployment rates one percentage point below the state average in the first quarter.

Arizona Personal Income Growth Surged

Arizona personal income growth surged in the fourth quarter of 2012, hitting 8.5% at an annual rate. The fourth quarter data is the most recent available as of this writing. That was slightly above the national growth rate of 8.1%. Much of the strong fourth quarter growth is explained by a huge increase in income from dividends, interest, and rent. This reflected decisions by companies to accelerate dividends payouts in anticipation of tax law changes. Indeed, Arizona income from dividends, interest, and rent rose by nearly one-third at an annual rate in the fourth quarter. Excluding income from dividends, interest, and rent, state personal income rose by 4.3% in the final quarter of the year. The preliminary data suggest that state personal income rose by 3.7% in 2012, down from 4.9% growth in 2011 and close to national growth.

Arizona Outlook: Gaining Momentum

The forecast calls for Arizona to continue to expand in 2013, with more jobs, income, and residents. However, growth will continue to seem slow by historical standards, as the intensifying federal fiscal drag holds back stronger state gains. Growth accelerates in 2014 and again in 2015.

Rising job growth means more progress in driving down the unemployment rate, which hits 6.8% in 2015, close to the expected national rate. However, the employment-to-population ratio only reaches 43.8% by 2015, well below pre-recession levels.

The housing recovery remains a key part of the forecast for accelerating growth during 2014-2015. We are seeing signs of rebound in Arizona, with declining foreclosures, rising house prices and permit activity, and declining rental and homeowner vacancy rates. This is good news, but the market is not back to normal yet. The number of state housing permits rose by just over 60% in 2012, with gains in both single and multi-family activity. Even so, there were just 21,726 permits issued in Arizona, according to final estimates from the Census Bureau, which is lower than anything seen in the state since the 1970s.

The forecast calls for housing activity to gradually pick up steam through 2015, with rising net migration driving gains in housing permits and construction activity. Rising net migration, combined with positive natural increase, translates into faster population gains in Arizona as well.

Accelerating job growth during the next two years means rising income growth as well. These gains translate into a rising standard of living for state residents, as they are larger than the expected rate of inflation and population growth. In addition, per capita income growth is expected to exceed the national rate, which means a slowly declining income gap.

Faster income growth translates into faster sales growth, with real retail sales growth forecast to hit 3.5% in 2015, after averaging 2.6% per year during the 2012-2014 period.

Sequester Risks

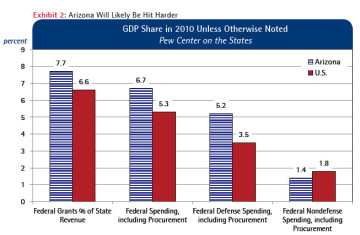

As Exhibit 2 suggests, Arizona is more exposed to federal spending cuts than the average state. According to the Pew Center on the States, federal grants in 2010 were 7.7% of state revenue, compared to 6.6% for the nation.

As Exhibit 2 suggests, Arizona is more exposed to federal spending cuts than the average state. According to the Pew Center on the States, federal grants in 2010 were 7.7% of state revenue, compared to 6.6% for the nation. That ranked Arizona 6th in the nation. In addition, federal spending (including procurement) was 6.7% of state GDP in 2010, compared to 5.3% for the nation. That ranked Arizona 13th in the nation. The baseline outlook assumes that the federal sequester ends this fall. If it lasts longer than expected, then its impact will increase and Arizona will be hit relatively hard.

Keep in mind that the sequester cuts will affect federal procurement spending, as well as direct federal expenditures. Associated job losses will show up in the private sector as well, particularly in manufacturing and professional and business services. These two sectors will be early barometers of the employment impact of the sequester in Arizona.